Capital One 2010 Annual Report Download - page 195

Download and view the complete annual report

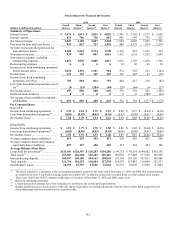

Please find page 195 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

175

Plaintiffs appealed that order to the Ninth Circuit Court of Appeals. The plaintiffs’ appeal challenges the dismissal of their claims

under National Bank Act, the Depository Institutions Deregulation Act of 1980 and the California Unfair Competition Law, but not

their antitrust conspiracy claims. In June 2009, the Ninth Circuit Court of Appeals stayed the matter pending the bankruptcy

proceedings of one of the defendant financial institutions. In December 2010, the Ninth Circuit Court of Appeals entered an additional

order continuing the stay of the matter pending the bankruptcy proceedings.

Between January and April 2010, eight substantially similar putative class actions were filed against COBNA and Capital One Services,

LLC (“COSI”) challenging various marketing practices relating to the payment protection product: Blackie v. Capital One Bank, et al.

(U.S. District Court for the Eastern District of Pennsylvania); Carr v. Capital One Bank, et al. (U.S. District Court for the District of New

Jersey); McCoy v. Capital One Bank, et al. (U.S. District Court for the Southern District of California); Mitchell v. Capital One Bank, et

al. (U.S. District Court for the Central District of California); Salazar v. Capital One Bank, et al. (U.S. District Court for the District of

South Carolina); Smith v. Capital One Bank, et al. (U.S. District Court for the District of Arkansas); Sullivan v. Capital One Bank, et al,

(U.S. District Court for the District of Connecticut); Watlington v. Capital One Bank, et al. (U.S. District Court for the Middle District of

North Carolina) (collectively “The Payment Protection Class Actions”). The Payment Protection Class Actions seek a range of remedies,

including compensatory damages, punitive damages, restitution, disgorgement, injunctive relief and attorneys’ fees. Each of these cases is

in early stages. In addition, in September 2009, the U.S. District Court for the Middle District of Florida certified a statewide class action

in Spinelli v. Capital One Bank, et al. with respect to the marketing of the payment protection product in Florida. In May 2010, the U.S.

Court of Appeals for the Eleventh Circuit denied COBNA’s and COSI’s petition for interlocutory review of the class certification order,

allowing the case to proceed toward the summary judgment stage. In May 2010, COBNA and COSI entered into a preliminary global

settlement with the various putative class counsel in The Payment Protection Class Actions. In August 2010, the Florida federal court

issued a preliminary approval order for the settlement. After hearings in November and December, 2010, the Florida federal court issued

a final approval order for the settlement. We believe the total expected costs of the settlement will be within the non-material litigation

reserve amount established in the second quarter of 2010, and as a result, we do not believe the amount necessary to resolve the litigation

will be material to our financial conditions or results of operations.

In July 2010, the U.S. Court of Appeals for the Ninth Circuit reversed a dismissal entered in favor of COBNA in Rubio v. Capital One

Bank, which was filed in the U.S. District Court for the Central District of California in 2007. The plaintiff in Rubio alleged in a putative

class action that COBNA breached its contractual obligations and violated the Truth In Lending Act (the “TILA”) and California’s Unfair

Competition Law (the “UCL”) when it raised interest rates on certain credit card accounts. The District Court granted COBNA’s motion

to dismiss all claims as a matter of law prior to any discovery. On appeal, the Ninth Circuit reversed the District Court’s dismissal with

respect to the TILA and UCL claims, remanding the case back to the District Court for further proceedings. The Ninth Circuit upheld the

dismissal of the plaintiff’s breach of contract claim, finding that COBNA was contractually allowed to increase interest rates. In

September 2010, the Ninth Circuit denied COBNA’s Petition for Panel Rehearing and Rehearing En Banc. In January, 2011, COBNA

filed a writ of certiorari with the United States Supreme Court, seeking leave to appeal the Ninth Circuit’s ruling.

The Capital One Bank Credit Card Interest Rate Multi-district Litigation matter involves similar issues as Rubio. This multi-district

litigation matter was created as a result of a June 2010 transfer order issued by the United States Judicial Panel on Multidistrict

Litigation (“MDL”), which consolidated for pretrial proceedings in the U.S. District Court for the Northern District of Georgia two

pending putative class actions against COBNA -- Nancy Mancuso, et al. v. Capital One Bank (USA), N.A., et al., (E.D. Virginia); and

Kevin S. Barker, et al. v. Capital One Bank (USA), N.A., (N.D. Georgia), A third action, Jennifer L. Kolkowski v. Capital One Bank

(USA), N.A., (C.D. California) was subsequently transferred into the MDL. On August 2, 2010, the plaintiffs in the MDL filed a

Consolidated Amended Complaint. The Consolidated Amended Complaint alleges in a putative class action that COBNA breached its

contractual obligations, and violated the Truth in Lending Act (the “TILA”), the California Consumers Legal Remedies Act, the

California Unfair Competition Law, the California False Advertising Act, the New Jersey Consumer Fraud Act, and the Kansas

Consumer Protection Act when it raised interest rates on certain credit card accounts. The parties are currently conducting discovery.

In January 2010, the West Virginia Attorney General filed suit against COBNA and various affiliates in Mason County, West

Virginia, challenging numerous credit card practices under the West Virginia Consumer Credit and Protection Act. The West Virginia

Attorney General seeks injunctive relief, consumer refunds, statutory damages, disgorgement, and attorneys’ fees. COBNA removed

the case to the U.S. District Court for the Southern District of West Virginia and filed a motion to dismiss the complaint. In July 2010,

the U.S. District Court for the Southern District of West Virginia remanded the case back to Mason County Circuit Court and denied

the motion to dismiss as moot. In August 2010, we filed a motion to dismiss and a motion to stay discovery pending resolution of the

motion to dismiss. In January 2011, the Court took our motion to dismiss under advisement, while permitting discovery to proceed.

On February 5, 2009, GreenPoint was named as a defendant in a lawsuit commenced in the Supreme Court of the State of New York,

New York County, by U.S. Bank National Association, Syncora Guarantee Inc. (formerly known as XL Capital Assurance Inc.) and

CIFG Assurance North America, Inc. (the “U.S. Bank Litigation”). Plaintiffs allege, among other things, that GreenPoint breached

certain representations and warranties in two contracts pursuant to which GreenPoint sold approximately 30,000 mortgage loans