Capital One 2010 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

141

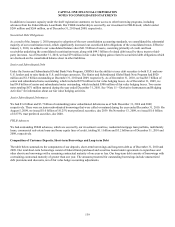

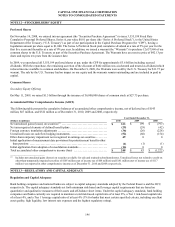

December 31,

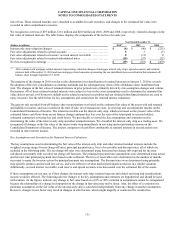

(Dollars in millions) 2010 2009

8.875% Subordinated Fixed Notes par value of $1,000,010 due 2040 ............................ 987 987

7.50% Subordinated Fixed Notes par value of $346,000 due 2066 .............................. 346 346

Unamortized Fees .......................................................................... 1 (1)

Total junior subordinated debentures ....................................................... 3,642 3,640

Secured borrowings (3)

Fixed, interest rates ranging from 4.56% to 6.40%, due 2012 ................................... 3,689 562

Variable, interest rates ranging from 0.28% to 4.76%, due 2012 to 2028 ......................... 12,606 1,718

Fair value hedge-related basis adjustments .................................................... (79)

—

Total secured borrowings .................................................................. 16,216 2,280

FHLB advances (4)

Fixed, interest rates ranging from 2.97% to 6.88%, due 2012 to 2023 ........................... 141 227

Variable, interest rate of 0.37% due 2014 ..................................................... 925 925

Total FHLB advances ......................................................................... 1,066 1,152

Total long-term debt .......................................................................... $ 28,690 $ 15,438

Total short-term borrowings and long-term debt ............................................. $ 41,796 $ 21,014

________________________

(1) Interest bearing deposits have a weighted average rate of 1.37% and 2.04% at December 31, 2010 and 2009, respectively.

(2) Floating rate junior subordinated notes have a weighted average rate of 3.339% and 3.301% at December 31, 2010 and 2009, respectively.

(3) Secured borrowings have a weighted average rate of 1.85% and 2.37% at December 31, 2010 and 2009, respectively.

(4) FHLB advances have a weighted average rate 1.249% and 2.245% at December 31, 2010 and 2009, respectively.

(5) Federal funds purchased have a weighted average rate of 0.23% and 0.11% at December 31, 2010 and 2009, respectively.

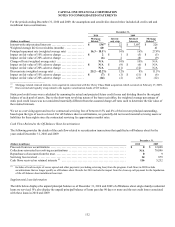

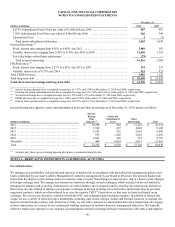

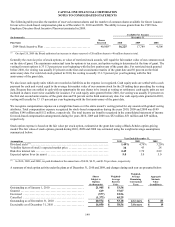

Interest-bearing time deposits, senior and subordinated notes and other borrowings as of December 31, 2010, mature as follows:

(Dollars in millions)

Interest-

Bearing

Time

Deposits (1)

Senior and

Subordinated

Notes Other

Borrowings Total

2011 .................................................

.

$ 10,208 $ 884 $ 12,222 $ 23,314

2012 .................................................

.

3,582 657 4,869 9,108

2013 .................................................

.

5,181 822 2,665 8,668

2014 .................................................

.

973 1,430 3,858 6,261

2015 .................................................

.

1,841 403 519 2,763

Thereafter ............................................

.

449 4,454 9,013 13,916

Total .................................................

.

$ 22,234 $ 8,650 $ 33,146 $ 64,030

________________________

(1) Includes only those interest bearing deposits which have a contractual maturity date.

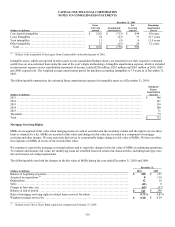

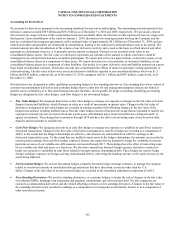

NOTE 11—DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

Use of Derivatives

We manage our asset/liability risk position and exposure to market risk in accordance with prescribed risk management policies and

limits established by our Asset Liability Management Committee and approved by our Board of Directors. Our primary market risk

stems from the impact on our earnings and our economic value of equity from changes in interest rates, and to a lesser extent, changes

in foreign exchange rates. We manage our interest rate sensitivity through several techniques, which include, but are not limited to,

changing the maturity and re-pricing characteristics of various balance sheet categories and by entering into interest rate derivatives.

Derivatives are also utilized to manage our exposure to changes in foreign exchange rates. Derivative instruments may be privately

negotiated contracts, which are often referred to as over-the-counter (“OTC”) derivatives, or they may be listed and traded on an

exchange. We execute our derivative contracts in both the OTC and exchange-traded derivative markets. In addition to interest rate

swaps, we use a variety of other derivative instruments, including caps, floors, options, futures and forward contracts, to manage our

interest rate and foreign currency risk. From time to time, we enter into customer-accommodation derivative transactions. We engage

in these transactions as a service to our commercial banking customers to facilitate their risk management objectives. We typically

offset the market risk exposure to our customer-accommodation derivatives through derivative transactions with other counterparties.