Capital One 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

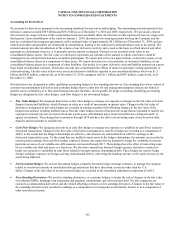

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

136

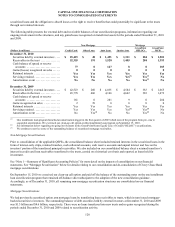

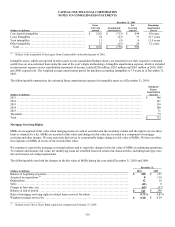

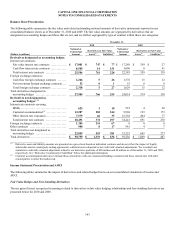

December 31, 2009

(Dollars in millions)

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

Remaining

Amortization

Period

Core deposit intangibles ....................................

.

$ 1,562 $ (713) $ 849 8.0 years

Lease intangibles ..........................................

.

54 (23) 31 22.7 years

Trust intangibles ...........................................

.

11 (5) 6 13.9 years

Other intangibles ...........................................

.

35 (15) 20 3.2 years

Total ....................................................

.

$ 1,662 $ (756) $ 906

________________________

(1) Relates to the acquisition of the legacy Sony Card portfolio in the third quarter of 2010.

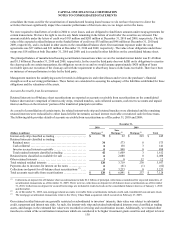

Intangible assets, which are reported in other assets on our consolidated balance sheets, are amortized over their respective estimated

useful lives on an accelerated basis using the sum of the year’s digits methodology. Intangible amortization expense, which is included

in non-interest expense on our consolidated statements of income, totaled $220 million, $235 million and $201 million in 2010, 2009

and 2008, respectively. The weighted average amortization period for purchase accounting intangibles is 7.4 years as of December 31,

2010.

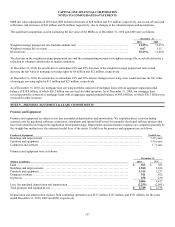

The following table summarizes the estimated future amortization expense for intangible assets as of December 31, 2010:

(Dollars in millions)

Estimated

Future

Amortization

Amounts

2011 ....................................................................................................

.

$ 196

2012 ....................................................................................................

.

161

2013 ....................................................................................................

.

130

2014 ....................................................................................................

.

100

2015 ....................................................................................................

.

71

Thereafter ...............................................................................................

.

75

Total ....................................................................................................

.

$ 733

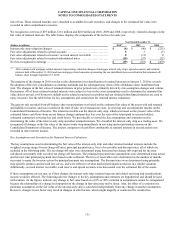

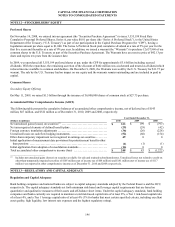

Mortgage Servicing Rights

MSRs are recognized at fair value when mortgage loans are sold or securitized in the secondary market and the right to service these

loans is retained for a fee. MSRs are recorded at fair value and changes in fair value are recorded as a component of mortgage

servicing and other income. We may enter into derivatives to economically hedge changes in fair value of MSRs. We have no other

loss exposure on MSRs in excess of the recorded fair value.

We continue to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing operations.

To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan type, note

rate and investor servicing requirements.

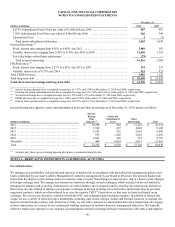

The following table sets forth the changes in the fair value of MSRs during the year ended December 31, 2010 and 2009:

December 31,

(Dollars in millions) 2010 2009

Balance at beginning of period ................................................................... $ 240 $ 151

Acquired in acquisitions (1) ...................................................................... 0 110

Originations ................................................................................... 12 16

Sales .......................................................................................... (42) 0

Change in fair value, net ........................................................................ (69) (37)

Balance at end of period ........................................................................ $ 141 $ 240

Ratio of mortgage servicing rights to related loans serviced for others .............................. 0.71% 0.81%

Weighted average service fee ................................................................... $ 0.28 $ 0.29

________________________

(1) Related to the Chevy Chase Bank acquisition completed on February 27, 2009.