Capital One 2010 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

168

assumptions management believes are appropriate to reflect the results of each business segment. Due to the integrated nature of our

business segments, estimates and judgments have been made in allocating certain revenue and expense items. Transactions between

segments are based on specific criteria or approximate third-party rates. We regularly assess the assumptions, methodologies and

reporting classifications used for segment reporting, which may result in the implementation of refinements or changes in future

periods.

Following is a description of the principles and methodologies used in preparing our business segment results.

• Net interest income: Interest income from loans held for investment and interest expense from deposits and other interest-bearing

liabilities are reflected within each applicable business segment. Because funding and asset/liability management are managed

centrally by our Corporate Treasury Group, net interest income for our business segments also includes the results of a funds

transfer pricing process that is intended to allocate a cost of funds used or credit for funds provided to all business segment assets

and liabilities, respectively, using a matched funding concept. Also, taxable-equivalent benefit of tax-exempt products is

allocated to each business unit with a corresponding increase in income tax expense.

• Non-interest income: Non-interest fees and other revenue associated with loans or customers managed by each business segment

and other direct revenues are accounted for within each business segment.

• Provision for loan and lease losses: The provisions for loan and lease losses are directly attributable to the business segment in

which the loans are managed.

• Non-interest expense: Non-interest expenses directly managed and incurred by a business segment are accounted for within each

business segment. We allocate certain non-interest expenses indirectly incurred by business segments, such as corporate support

functions, to each business segment based on various factors, including the actual cost of the services from the service providers,

the utilization of the services, the number of employees or other relevant factors.

• Goodwill and other intangible assets: Goodwill and other intangible assets are assigned to business segments based on the

relative fair value of each segment. Intangible amortization is included in the results of the applicable segment.

• Income taxes: Income taxes are assessed for each business segment based on a standard tax rate with the residual tax expense or

benefit to arrive at the consolidated effective tax rate included in the Other category.

• Loans held for investment: Loans are reported within each business segment based on product or customer type.

• Deposits: Deposits are reported within each business segment based on product or customer type.

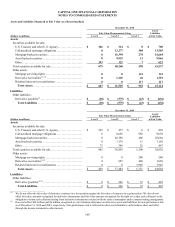

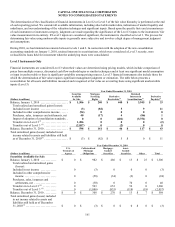

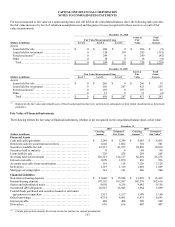

Segment Results and Reconciliation

The following tables provide a summary of our business segment results for the years ended December 31, 2010, 2009 and 2008 and

selected balance sheet data as of December 31, 2010 and 2009. Total consolidated assets are not allocated among our business

segments in the information that is reviewed by our chief operating decision maker. The total of our business segment results and

“Other” category, or “Total Managed,” differs from our total consolidated reported results. The impact of these differences is reflected

in the “Securitization Adjustments” category. The securitization adjustments remove the impact of presenting off-balance sheet

securitized loans in our business segment results in the same manner as on-balance sheet loans to reconcile to our total consolidated

reported results.

We may periodically change our business segments or reclassify business segment results based on modifications to our management

reporting methodologies and changes in organizational alignment.