Capital One 2010 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

139

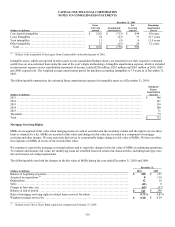

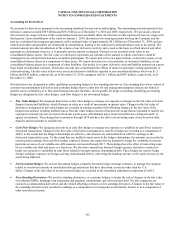

In addition to issuance capacity under the shelf registration statement, we have access to other borrowing programs, including

advances from the Federal Home Loan Bank. Our FHLB membership is secured by our investment in FHLB stock, which totaled

$269 million and $264 million, as of December 31, 2010 and 2009, respectively.

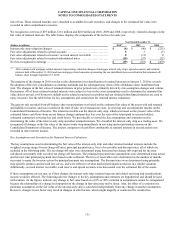

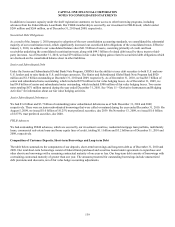

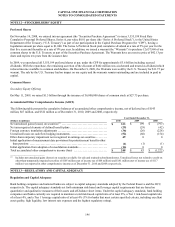

Securitized Debt Obligations

As a result of the January 1, 2010 prospective adoption of the new consolidation accounting standards, we consolidated the substantial

majority of our securitization trusts, which significantly increased our securitized debt obligations of the consolidated trusts. Effective

January 1, 2010, we added to our consolidated balance sheet $41.9 billion of assets, consisting primarily of credit card loan

receivables underlying the consolidated securitization trusts, along with $44.3 billion of related debt issued by these trusts to third-

party investors. As of December 31, 2010, we had $79 million in fair value hedging gains related to securitized debt obligations which

are disclosed on the consolidated balance sheet in other liabilities.

Senior and Subordinated Debt

Under the Senior and Subordinated Global Bank Note Program, COBNA has the ability to issue debt securities to both U.S. and non-

U.S. lenders and to raise funds in U.S. and foreign currencies. The Senior and Subordinated Global Bank Note Program had $820

million and $1.3 billion outstanding at December 31, 2010 and 2009, respectively. As of December 31, 2010, we had $8.7 billion of

senior and subordinated notes outstanding, which included $578 million in fair value hedging losses. As of December 31, 2009, we

had $9.0 billion of senior and subordinated notes outstanding, which included $300 million of fair value hedging losses. Two senior

notes totaling $671 million matured during the year ended December 31, 2010. See “Note 11—Derivative Instruments and Hedging

Activities” for information about our fair value hedging activities.

Junior Subordinated Debentures

We had $3.6 billion and $3.7 billion of outstanding junior subordinated debentures as of both December 31, 2010 and 2009,

respectively. There were no junior subordinated borrowings that were called or matured during the year ended December 31, 2010. On

August 5, 2009, we issued $1.0 billion of 10.25% trust preferred securities, due 2039. On November 13, 2009, we issued $1.0 billion

of 8.875% trust preferred securities, due 2040.

FHLB Advances

We had outstanding FHLB advances, which are secured by our investment securities, residential mortgage loan portfolio, multifamily

loans, commercial real-estate loans and home equity lines of credit, totaling $1.1 billion and $3.2 billion as of December 31, 2010 and

2009, respectively.

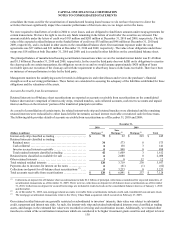

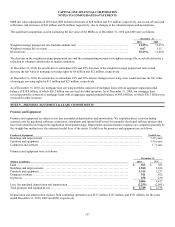

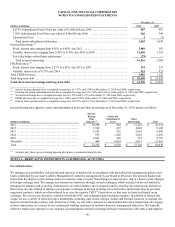

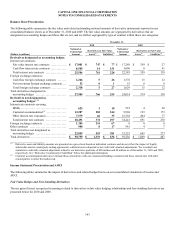

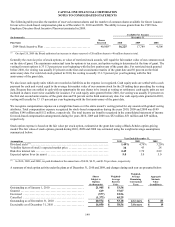

Composition of Customer Deposits, Short-term Borrowings and Long-term Debt

The table below summarizes the components of our deposits, short-term borrowings and long-term debt as of December 31, 2010 and

2009. Our total short-term borrowings consist of federal funds purchased and securities loaned under agreements to repurchase and

other short-term borrowings with a remaining contractual maturity of one year or less. Our long-term debt consists of borrowings with

a remaining contractual maturity of greater than one year. The amounts presented for outstanding borrowings include unamortized

debt premiums and discounts, net of fair value hedge accounting adjustments.