Capital One 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

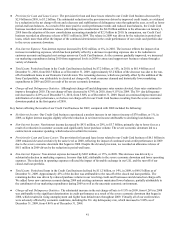

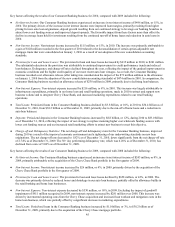

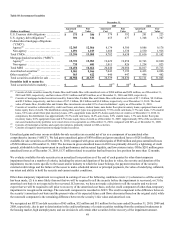

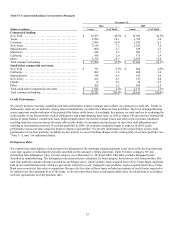

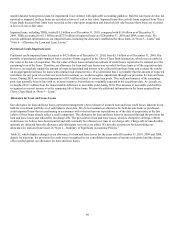

Table 12: Reported Loan Maturity Schedule

December 31, 2010

(Dollars in millions)

Amounts

Due One Year

or Less

Amounts Due

After One Year

Through Five

Years

Amounts Due

After Five

Years Total

Fixed rate:

Credit card(1) .......................................

.

$ 4,146 $ 12,644 $ 164 $ 16,954

Consumer ..........................................

.

935 16,191 10,317 27,443

Commercial ........................................

.

2,945 8,526 4,315 15,786

Other ..............................................

.

27 10 105 142

Total fixed-rate loans ................................

.

8,053 37,371 14,901 60,325

Variable rate:

Credit card(1) .......................................

.

44,417

—

—

44,417

Consumer ..........................................

.

6,408 493 39 6,940

Commercial ........................................

.

12,483 1,407 66 13,956

Other ..............................................

.

253 46 10 309

Total variable-rate loans ...............................

.

$ 63,561 $ 1,946 $ 115 $ 65,622

Total .................................................

.

$ 71,614 $ 39,317 $ 15,016 $ 125,947

________________________

(1) Due to the revolving nature of credit card loans, we report all variable-rate credit card loans as due in one year or less. We report fixed-rate

credit card loans with introductory rates that expire after a certain period of time as due in one year or less. We assume that our remaining fixed-

rate credit card loans will mature within one to three years

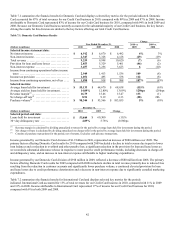

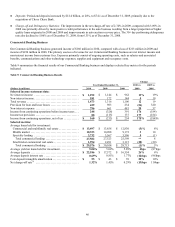

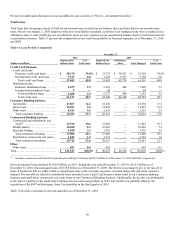

We market our credit card products on a national basis throughout the United States, Canada and the United Kingdom. The Credit

Card segment accounted for $61.4 billion, or 49% of our total loan portfolio as of December 31, 2010, compared with 50% as of

December 31, 2009. Because of the diversity of our credit card products and national marketing approach, no single geographic

concentration exists within the credit card portfolio. Table 13 displays the geographic concentration of our credit card loan portfolio as

of December 31, 2010 and 2009.

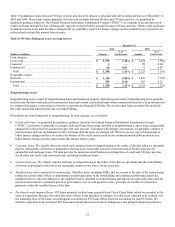

Table 13: Credit Card Concentrations (Managed)

December 31,

2010 2009

(Dollars in millions) Loans % of Total Loans % of Total

Domestic card:

California ............................................ $ 6,242 10.2% $ 7,192 10.5%

Texas ................................................ 3,633 5.9 4,097 6.0

N

ew York ............................................ 3,599 5.8 3,917 5.7

Florida ............................................... 3,298 5.4 3,759 5.5

Illinois ............................................... 2,403 3.9 2,653 3.9

Pennsylvania ......................................... 2,389 3.9 2,641 3.8

Ohio ................................................. 2,109 3.4 2,384 3.5

N

ew Jersey ........................................... 1,971 3.2 2,146 3.1

Michigan ............................................. 1,716 2.8 1,989 2.9

Other ................................................ 26,489 43.2 29,522 43.1

Total domestic card ................................... $ 53,849 87.7% $ 60,300 88.0%

International card:

United Kingdom ...................................... $ 4,102 6.7% $ 4,717 6.9%

Canada ............................................... 3,420 5.6 3,507 5.1

Total international card ................................ $ 7,522 12.3% $ 8,224 12.0%

Total credit card ...................................... $ 61,371 100.0% $ 68,524 100.0%