Capital One 2010 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

112

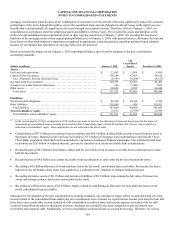

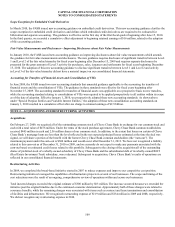

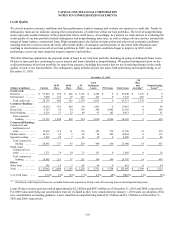

(3) Consists of debt securities issued by Fannie Mae and Freddie Mac with amortized costs of $200 million and $454 million, as of December 31,

2010 and 2009, respectively, and fair values of $213 million and $476 million, as of December 31, 2010 and 2009, respectively.

(4) Consists of mortgage-backed securities issued by Fannie Mae, Freddie Mac and Ginnie Mae with amortized costs of $17.1 billion, $8.1 billion

and $2.9 billion, respectively, and fair values of $17.3 billion, $8.3 billion and $3.0 billion, respectively, as of December 31, 2010. The book

value of Fannie Mae, Freddie Mac and Ginnie Mae investments exceeded 10% of our stockholders’ equity as of December 31, 2010.

(5) Consists of securities collateralized by credit card loans, auto loans, auto dealer floor plan inventory loans, equipment loans, and home equity

lines of credit. The distribution among these asset types was approximately 77.8 % credit card loans, 7.2% student loans, 6.7% auto loans, 5.6%

auto dealer floor plan inventory loans, 2.5 % equipment loans, and 0.2% home equity lines of credit as of December 31, 2010. In comparison,

the distribution was approximately 76.3% credit card loans, 6.9% student loans, 14.0% auto loans, 1.7% auto dealer floor plan inventory loans,

0.8% equipment loans and 0.3% home equity lines of credit as of December 31, 2009. Approximately 90.1 % of the securities in our asset-

backed security portfolio were rated AAA or its equivalent as of December 31, 2010, compared with 84.2% as of December 31, 2009.

(6) Consists of municipal securities and equity investments, primarily related to CRA activities.

(7) Consists of negative amortization mortgage-backed securities.

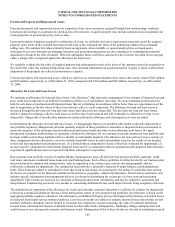

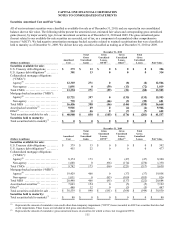

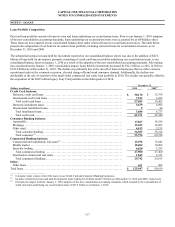

Securities Available for Sale in a Gross Unrealized Loss Position

The table below provides, by major security type, information about our available-for-sale securities in a gross unrealized loss position

and the length of time that individual securities have been in a continuous unrealized loss position as of December 31, 2010 and 2009.

December 31, 2010

Less than 12 Months 12 Months or Longer Total

(Dollars in millions) Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Securities available for sale:

U.S. Treasury debt obligations ........ $ 0 $ 0 $ 0 $ 0 $ 0 $ 0

U.S. Agency debt obligations(1) ........ 0 0 0 0 0 0

CMOs:

Agency(2) .......................... 1,253 (7) 279 (1) 1,532 (8)

Non-agency ....................... 17 0 976 (72) 993 (72)

Total CMOs ......................... 1,270 (7) 1,255 (73) 2,525 (80)

MBS:

Agency(2) .......................... 5,318 (134) 177 (1) 5,495 (135)

Non-agency ....................... 28 0 590 (55) 618 (55)

Total MBS .......................... 5,346 (134) 767 (56) 6,113 (190)

Asset-backed securities ............... 1,411 (2) 33 (2) 1,444 (4)

Other ............................... 300 (1) 80 (6) 380 (7)

Total securities available for sale in a

gross unrealized loss position ....... $ 8,327 $ (144) $ 2,135 $ (137) $ 10,462 $ (281)