Capital One 2010 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2010 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

154

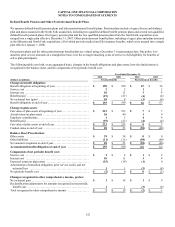

To develop the expected long-term rate of return on plan assets assumption, consideration was given to the current level of expected

returns on risk-free investments (primarily government bonds), the historical level of the risk premium associated with the other asset

classes in which the portfolio is invested and the expectations for future returns of each asset class. The expected return for each asset

class was then weighted based on the target asset allocation to develop the expected long-term rate of return on the plan assets

assumption for the portfolio.

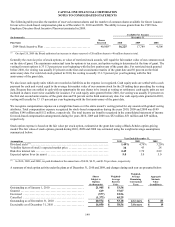

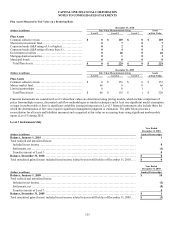

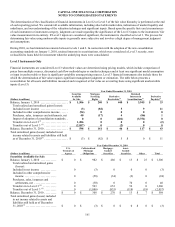

Assumed health care trend rates have a significant effect on the amounts reported for the other postretirement benefit plans. A one-

percentage point change in assumed health care cost trend rates would have the following effects:

Year ended December 31,

2010 2009

1% Increase 1% Decrease 1% Increase 1% Decrease

Effect on year-end postretirement benefit obligation ........... $ 6 $ (5) $ 6 $ (5)

Effect on total service and interest cost components ........... 0 0 1 (1)

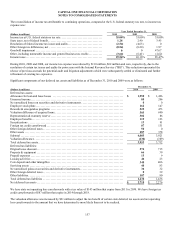

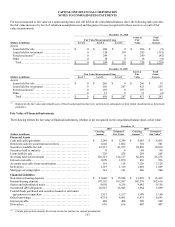

Plan Assets

The qualified defined benefit pension plan asset allocations as of the annual measurement dates are as follows:

December 31,

2010 2009

Common collective trusts(1) ................................................................. 73.9% 69.4

%

Money market fund ........................................................................ 3.2 30.1

Limited partnerships ....................................................................... 0.0 0.5

Corporate bonds (S&P rating of A or higher) ................................................. 0.8 0.0

Corporate bonds (S&P rating of lower than A) ............................................... 1.7 0.0

Government securities ..................................................................... 20.1 0.0

Mortgage backed securities ................................................................. 0.3 0.0

Total ..................................................................................... 100.0% 100.0

%

________________________

(1) Common collective trusts include domestic and international equity securities.

The investment guidelines provide the following asset allocation targets and ranges: domestic equity target of 50% and allowable

range of 45% to 55%, international equity target of 20% and allowable range of 15% to 25%, and fixed income securities target of

30% and allowable range of 25% to 40%.

Plan assets are invested using a total return investment approach whereby a mix of equity securities and debt securities are used to

preserve asset values, diversify risk and enhance our ability to achieve our long-term investment return benchmark. Investment

strategies and asset allocations are based on careful consideration of plan liabilities, the plan’s funded status and our financial

condition. Investment performance and asset allocation are measured and monitored on a quarterly basis.

Plan assets are managed in a balanced portfolio comprised of three major components: a domestic equity portion, an international

equity portion and a domestic fixed income portion. The expected role of plan equity investments is to maximize the long-term real

growth of fund assets, while the role of fixed income investments is to generate current income, provide for more stable periodic

returns and provide some protection against a prolonged decline in the market value of fund equity investments.

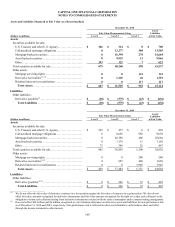

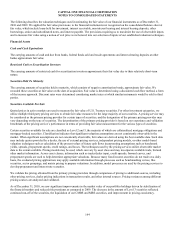

Fair Values Measurement

For information on fair value measurements, including descriptions of Level 1, 2 and 3 of the fair value hierarchy and the valuation

methods we utilize, see “Note 1—Summary of Significant Accounting Policies” and “Note 19—Fair Value of Financial Instruments.”