Capital One 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.resources. Our business segment results are intended to reflect each segment as if it were a stand-alone business.

We use an internal management and reporting process to derive our business segment results. Our internal

management and reporting process employs various allocation methodologies, including funds transfer pricing,

to assign certain balance sheet assets, deposits and other liabilities and their related revenue and expenses directly

or indirectly attributable to each business segment. Total interest income and net fees are directly attributable to

the segment in which they are reported. The net interest income of each segment reflects the results of our funds

transfer pricing process, which is primarily based on a matched maturity method that takes into consideration

market rates. Our funds transfer pricing process provides a funds credit for sources of funds, such as deposits

generated by our Consumer Banking and Commercial Banking businesses, and a funds charge for the use of

funds by each segment. The allocation process is unique to each business segment and acquired businesses.

We may periodically change our business segments or reclassify business segment results based on modifications

to our management reporting methodologies and changes in organizational alignment. In the first quarter of

2012, we re-aligned the loan categories reported by our Commercial Banking business and the loan customer and

product types included within each category. As a result of this re-alignment, we now report three product

categories: commercial and multifamily real estate, commercial and industrial loans and small-ticket commercial

real estate, which is a run-off portfolio. We previously reported four categories within our Commercial Banking

business: commercial and multifamily real estate, middle market, specialty lending and small-ticket commercial

real estate. Middle market and specialty lending related products are included in commercial and industrial loans.

All affordable housing tax-related investments, some of which were previously included in the “Other” segment,

are now included in the commercial and multifamily real estate category of our Commercial Banking business.

Prior period amounts have been recast to conform to the current period presentation.

We refer to the business segment results derived from our internal management accounting and reporting process

as our “managed” presentation, which differs in some cases from our reported results prepared based on

U.S. GAAP. There is no comprehensive, authoritative body of guidance for management accounting equivalent

to U.S. GAAP; therefore, the managed basis presentation of our business segment results may not be comparable

to similar information provided by other financial service companies. In addition, our individual business

segment results should not be used as a substitute for comparable results determined in accordance with U.S.

GAAP.

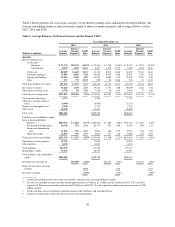

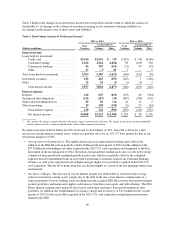

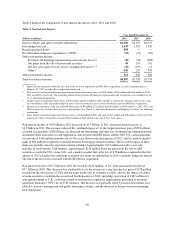

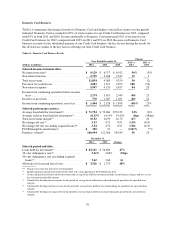

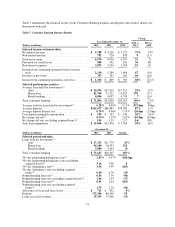

Below we summarize our business segment results for 2012, 2011 and 2010 and provide a comparative

discussion of these results. We also discuss changes in our financial condition and credit performance statistics as

of December 31, 2012, compared with December 31, 2011. We provide additional information on the allocation

methodologies used to derive our business segment results and a reconciliation of our total business segment

results to our reported consolidated results in “Note 20—Business Segments.” We provide information on the

outlook for each of our business segments above under “Executive Summary and Business Outlook.”

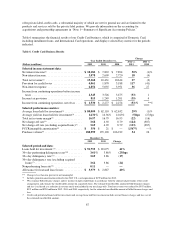

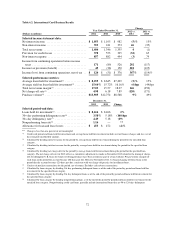

Credit Card Business

Our Credit Card business generated income from continuing operations of $1.5 billion in 2012 and $2.3 billion in

both 2011 and 2010. The primary sources of revenue for our Credit Card business are interest income and non-

interest income from customers and interchange fees. Expenses primarily consist of ongoing operating costs,

such as salaries and associate benefits, occupancy and equipment, professional services, communications and

data processing technology expenses, as well as marketing expenses.

Significant acquisitions affecting the results of our Credit Card business include: (i) the 2012 U.S. card

acquisition, which added approximately $27.8 billion in outstanding credit card receivables designated as held

for investment to our Domestic Card business at closing; (ii) the acquisition of the existing Kohl’s credit card

loan portfolio, which added approximately $3.7 billion of loans to our Domestic Card business at acquisition; and

(iii) the acquisition of the existing HBC loan portfolio, which added approximately $1.4 billion of loans to our

International Card business at acquisition. These acquisitions include partnership agreements with third parties to

66