Capital One 2012 Annual Report Download - page 67

Download and view the complete annual report

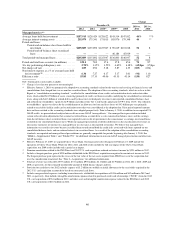

Please find page 67 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Total Company Expectations

Our strategies and actions are designed to deliver and sustain strong returns and capital generation through the

acquisition and retention of franchise-enhancing customer relationships across our businesses. We believe that

franchise-enhancing customer relationships create and sustain significant long-term value through low credit

costs, long and loyal customer relationships and a gradual build in loan balances and revenues over time.

Examples of franchise-enhancing customer relationships include rewards customers and new partnerships in our

Credit Card business, retail deposit customers in our Consumer Banking business and primary banking

relationships with commercial customers in our Commercial Banking business. We intend to grow these

customer relationships by continuing to invest in scalable infrastructure and operating platforms that are

appropriate for a bank of our size and business mix so that we can meet the rising regulatory and compliance

expectations facing all banks and deliver a “brand-defining” customer experience that builds and sustains a

valuable, long-term customer franchise. The ING Direct and 2012 U.S. card acquisitions strengthened and

expanded our customer base, and, over time, we expect to expand and deepen our customer relationships with

new products and services.

We expect average interest-earning assets will decline in 2013. We expect average loan balances for full-year

2013 to decline from average loan balances in the fourth quarter of 2012, as significant run-off of mortgage and

card loans we acquired, coupled with the sale of the Best Buy loan portfolio, is partially offset by growth in our

businesses. We expect run-off and sales of approximately $18 billion in ending loan balances in 2013, primarily

comprised of approximately $9 billion in run-off of mortgage loans acquired from ING Direct and Chevy Chase

Bank, approximately $7 billion from the sale of the Best Buy loan portfolio and approximately $2 billion in run-

off of other credit card loans purchased in the 2012 U.S. card acquisition. We expect this decline to be partially

offset by growth in certain of our businesses, including parts of Domestic Card, Auto and Commercial Banking.

However, we expect continued weak consumer demand across our Credit Card and Auto lending businesses, as

well as intensifying competition in several businesses, particularly Auto and Commercial and Industrial lending.

We expect net interest margin to be modestly higher in 2013 versus 2012 levels, with steady yield on average

earning assets and an expected reduction in interest expense.

We expect overall non-interest expense in 2013 to total approximately $12.5 billion, or just over $3.1 billion on

average per quarter. We expect total annual non-interest expense, excluding marketing, to be approximately $11

billion dollars in 2013 and marketing expense for 2013 to be approximately $1.5 billion. We believe our actions

have created a well-positioned balance sheet with strong capital and liquidity levels, and a strong capital

generation trajectory. We expect to exceed an assumed Basel III Tier 1 common ratio internal target of 8 percent

in early 2013. Our estimated Basel III capital trajectory includes the estimated impact of implementing the Basel

II Advanced Approaches to calculate regulatory capital, which we expect will apply to us in 2016 or later. The

assumed 8% Basel III Tier 1 common ratio target assumes a buffer of 50 basis points for a systemically

important financial institution (“SIFI”) under applicable rules and regulations and a further buffer of 50 basis

points to cover potential volatility in both the numerator and denominator of the Tier 1 common ratio. Our actual

operating levels for capital will vary over time depending on our outlook on near-to-medium term growth, our

view of where we are in the economic cycle and our resilience under ongoing stress-testing processes. The

assumed Basel III Tier 1 common level is estimated based on our current interpretation, expectations and

understanding of the Basel III capital rules and other capital regulations proposed by U.S. regulators and the

application of such rules to our businesses as currently conducted. Basel III calculations are necessarily subject to

change based on, among other things, the scope and terms of the final rules and regulations, model calibration

and other implementation guidance, changes in our businesses and certain actions of management, including

those affecting the composition of our balance sheet. We believe this ratio provides useful information to

investors and others by measuring our progress against expected future regulatory capital standards.

48