Capital One 2012 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Reputation Risk Management

The General Counsel is responsible for managing our overall reputation risk. Reputation risks associated with

daily interactions are managed by our business areas. Business area activities are controlled by the frameworks

set forth in the Reputation Risk Management Policy and other risk management policies. Each business area

determines how much risk it is willing to accept and when it is prudent to execute mitigation activities. From

time to time, senior management conducts detailed assessments of our business practices and evaluates them in

terms of their potential impact on Capital One’s reputation. The Reputation Risk Management Policy sets forth

the obligation of each business area, with direction and guidance from the Reputation Risk Steward and his or her

designee, to identify, assess and determine whether and how best to mitigate its reputation risk. The Reputation

Risk Steward is responsible for reporting on the assessments of our aggregate reputation risk, as well as the state

of our reputation with specific stakeholder groups, to the Chief Risk Officer, the Chief Executive Officer, the

Risk Management Committee and the Audit and Risk Committee of the Board of Directors, as appropriate.

Strategic Risk Management

The Chief Executive Officer is responsible for our strategy. The Chief Executive Officer develops an overall

corporate strategy and leads alignment of the entire organization with this strategy through definition of strategic

imperatives and top-down communication. The Chief Executive Officer and other senior executives spend

significant time throughout the entire company sharing our strategic imperatives to promote an understanding of

our strategy and connect it to day-to-day associate activities to enable effective execution. Division Presidents are

accountable for defining business strategy within the context of the overall corporate level strategy and strategic

imperatives. Business strategies are integrated into the corporate strategy and are reviewed separately and

together on an annual basis by the Chief Executive Officer and the Board of Directors.

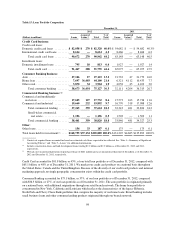

CREDIT RISK PROFILE

Our loan portfolio accounts for the substantial majority of our credit risk exposure. These activities are also

governed under our credit policy and are subject to independent review and approval. Below we provide

information about our primary loan products, the composition of our loan portfolio, key concentrations and credit

performance metrics.

We also engage in certain non-lending activities that may give rise to credit and counterparty settlement risk,

including the purchase of securities for our investment securities portfolio, entering into derivative transactions to

manage our market risk exposure and to accommodate customers, foreign exchange transactions and providing

deposit overdraft services. We provide additional information on credit risk related to our investment securities

portfolio under “Consolidated Balance Sheet Analysis—Investment Securities” and credit risk related to

derivative transactions in “Note 11—Derivative Instruments and Hedging Activities.”

Primary Loan Products

We provide a variety of lending products. Our primary products include credit cards, auto loans, home loans and

commercial loans.

•Credit cards: We market a range of credit card products across the credit spectrum and through a variety of

channels. Our credit cards generally have variable interest rates. Credit card accounts are underwritten using

an automated underwriting system based on predictive models that we have developed. The underwriting

criteria, which are customized for individual products and marketing programs, are established based on an

analysis of the net present value of expected revenues, expenses and losses, subject to a further analysis

using a variety of stress conditions. Underwriting decisions are generally based on credit bureau

information, including payment history, debt burden and credit scores, such as FICO, and on other factors,

such as applicant income. We maintain a credit card securitization program and selectively sell charged-off

96