Capital One 2012 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.credit card loans. Prior to February 1, 2013, we had not securitized any credit card loans since 2009. On

February 1, 2013, we executed our first credit card securitization transaction in over three and a half years

by issuing $750 million of 3-year, AAA rated, fixed-rate notes under our credit card securitization trust.

•Auto loans: We market a range of auto loan products across the credit spectrum. Customers are acquired

through a network of auto dealers and direct marketing. Our auto loans generally have fixed interest rates

and loan terms of 72 months or less. Loan size limits are customized by program and subject to a current

maximum of $75,000. Similar to credit card accounts, the underwriting criteria are customized for

individual products and marketing programs and based on analysis of net present value of expected

revenues, expenses and losses, subject to maintaining resilience under a variety of stress conditions.

Underwriting decisions are generally based on an applicant’s income, estimated debt-to-income ratio, and

credit bureau information, along with collateral characteristics such as loan-to-value ratio. We generally

retain all of our auto loans, though we have securitized auto loans and sold charged-off auto loans in the past

and may do so in the future.

•Home loans: Most of the existing home loans in our loan portfolio were originated by banks we acquired.

The underwriting standards for these loans were less restrictive than our current underwriting standards.

Currently, we originate residential mortgage and home equity loans through our branches, direct marketing,

and dedicated home loan officers. Our home loan products include conforming and non-conforming fixed

rate and adjustable rate mortgage loans, as well as first and second lien home equity loans and lines of

credit. Our underwriting standards for conforming loans are designed to meet the underwriting standards

required by Fannie Mae, Freddie Mac or Federal Housing Administration (“FHA”)/ Veterans Affairs

(“VA”) (the “agencies”) at a minimum, and we sell most of our conforming loans to the agencies. We

generally retain non-conforming mortgages and home equity loans and lines of credit. Our underwriting

policy limits for these loans include: (1) a maximum loan-to-value ratio of 80% for loans without mortgage

insurance; (2) a maximum loan-to-value ratio of 95% for loans with mortgage insurance or for home equity

products; (3) a maximum debt-to-income ratio of 50%; and (4) a maximum loan amount of $3.0 million.

Our underwriting procedures are intended to verify the income of applicants and obtain appraisals to

determine home values. We may, in limited instances, use automated valuation models to determine home

values.

•Commercial loans. We offer a range of commercial lending products, including loans secured by

commercial real estate and loans to middle market industrial and service companies. Our commercial loans

may have a fixed or variable interest rate; however, the majority of our commercial loans have variable

rates. Our underwriting standards require an analysis of the borrower’s financial condition and prospects, as

well as an assessment of the industry in which the borrower operates. Where relevant, we evaluate and

appraise underlying collateral and guarantees. We maintain underwriting guidelines and limits for major

types of borrowers and loan products that specify, where applicable, guidelines for debt service coverage,

leverage, loan-to-value ratio and standard covenants and conditions. We assign a risk rating and establish a

monitoring schedule for loans based on the risk profile of the borrower, industry segment, source of

repayment, the underlying collateral and guarantees (if any) and current market conditions. Although we

generally retain commercial loans, we may syndicate large positions for risk mitigation purposes. In

addition, we have sold impaired commercial loans in the past and may do so in the future.

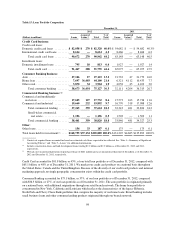

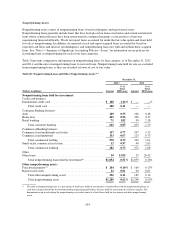

Loan Portfolio Composition

Total loans that we manage consist of held-for-investment loans recorded on our consolidated balance sheets and

loans held in our securitization trusts. Loans underlying our securitization trusts are reported on our consolidated

balance sheets in restricted loans for securitization investors. Table 15 presents the composition of our total loan

portfolio, by business segment, as of December 31, 2012 and 2011. Table 15 also displays acquired loans

accounted for based on estimated cash flows expected to be collected, which consists of a limited portion of the

credit card loans acquired in the 2012 U.S. card acquisition and the substantial majority of consumer and

commercial loans acquired in the ING Direct and Chevy Chase Bank acquisitions. See the discussion of “Loans

Acquired” below in this section for further information.

97