Capital One 2012 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.delinquent for an extended period of time and other loans with significant risk of loss as nonperforming, the level

of nonperforming assets represents another indicator of the potential for future credit losses. In addition to

delinquency rates, the geographic distribution of our loans provides insight as to the credit quality of the portfolio

based on regional economic conditions.

We use borrower credit scores in underwriting for most consumer loans. We do not use credit scores as a primary

indicator of credit quality, because product differences, loan structure, and other factors drive large differences in

credit quality for a given credit score, and because a borrower’s credit score tends to be a lagging indicator of

credit quality. We continuously adjust our credit line management of credit lines and collection strategies based

on customer behavior and risk profile changes.

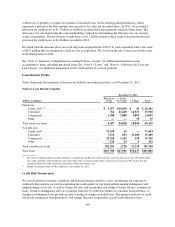

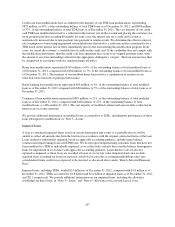

As noted above, our Credit Card business accounted for $91.8 billion, or 45%, of our total loan portfolio as of

December 31, 2012, with Domestic Card accounting for $83.1 billion, or 40%, of our total loan portfolio as of

December 31, 2012. Based on our most recent data, we estimate that approximately one-third of our Domestic

Card portfolio had credit scores less than 660 or no score, based on loan balances, as of December 31, 2012,

relatively consistent with the proportion of the Domestic Card portfolio with credit scores below 660 or no score

as of December 31, 2011. For loans related to the 2012 U.S. card acquisition and certain other partnerships, data

is obtained on a lagged basis.

We present information in the section below on the credit performance of our loan portfolio, including the key

metrics we use in tracking changes in the credit quality of our loan portfolio. Loans acquired as part of the CCB,

ING Direct and 2012 U.S. card acquisitions are included in the denominator used in calculating the credit quality

metrics presented below. Because some of these loans are accounted for based on expected cash flows to be

collected, which takes into consideration future credit losses expected to be incurred, there are no charge-offs or

an allowance associated with these loans unless the estimated cash flows expected to be collected decrease

subsequent to acquisition. In addition, these loans are not classified as delinquent or nonperforming even though

the customer may be contractually past due because we expect that we will fully collect the carrying value of

these loans. The accounting and classification of these loans may significantly alter some of our reported credit

quality metrics. We therefore supplement certain reported credit quality metrics with metrics adjusted to exclude

the impact of these acquired loans.

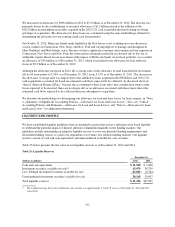

Delinquency Rates

We consider the entire balance of an account to be delinquent if the minimum required payment is not received

by the first statement cycle date equal to or following the due date specified on the customer’s billing statement.

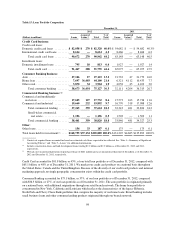

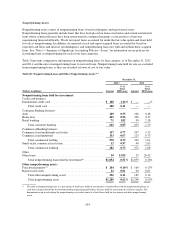

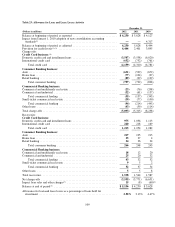

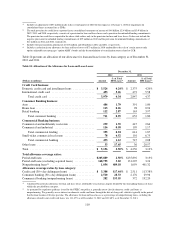

Table 17 compares 30+ day performing and total 30+ day delinquency rates, by loan category, as of

December 31, 2012 and 2011. Table 17 also presents these metrics adjusted to exclude from the denominator

acquired loans accounted for based on estimated cash flows expected to be collected over the life of the loans.

Our 30+ day delinquency metrics include all held-for-investment loans that are 30 or more days past due,

whereas our 30+ day performing delinquency metrics include loans that are 30 or more days past due and that are

also currently classified as performing and accruing interest. The 30+ day delinquency and 30+ day performing

delinquency metrics are generally the same for credit card loans, as we continue to classify the substantial

majority of credit card loans as performing until the account is charged-off, typically when the account is

180 days past due. See “Note 1—Summary of Significant Accounting Policies—Loans” for information on our

policies for classifying loans as nonperforming for each of our loan categories.

101