Capital One 2012 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

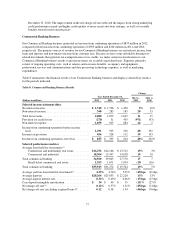

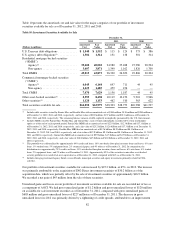

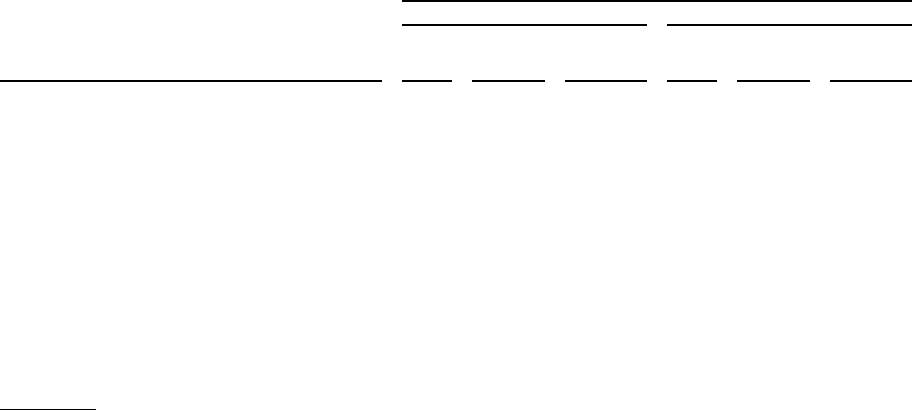

Table 14 provides a comparison of our capital ratios under the Federal Reserve’s capital adequacy standards and

the capital ratios of the Banks under the OCC’s capital adequacy standards as of December 31, 2012 and 2011.

Table 14: Capital Ratios Under Basel I(1)

December 31,

(Dollars in millions)

2012 2011

Capital

Ratio

Minimum

Capital

Adequacy

Well

Capitalized

Capital

Ratio

Minimum

Capital

Adequacy

Well

Capitalized

Capital One Financial Corp:(2)

Tier 1 common(3) ........................ 11.0% N/A N/A 9.7% N/A N/A

Tier 1 risk-based capital(4) ................. 11.3 4.0% 6.0% 12.0 4.0% 6.0%

Total risk-based capital(5) ................. 13.6 8.0 10.0 14.9 8.0 10.0

Tier 1 leverage(6) ........................ 8.7 4.0 N/A 10.1 4.0 N/A

Capital One Bank (USA) N.A. (“COBNA”):

Tier 1 risk-based capital(4) ................. 11.3% 4.0% 6.0% 11.2% 4.0% 6.0%

Total risk-based capital(5) ................. 14.7 8.0 10.0 15.0 8.0 10.0

Tier 1 leverage(6) ........................ 10.4 4.0 5.0 10.2 4.0 5.0

Capital One, N.A. (“CONA”):

Tier 1 risk-based capital(4) ................. 13.6% 4.0% 6.0% 11.0% 4.0% 6.0%

Total risk-based capital(5) ................. 14.9 8.0 10.0 12.2 8.0 10.0

Tier 1 leverage(6) ........................ 9.1 4.0 5.0 8.7 4.0 5.0

(1) Calculated under capital standards and regulations based on the international capital framework commonly known as Basel I. Capital

ratios that are not applicable are denoted by “N/A.”

(2) The regulatory framework for prompt corrective action does not apply to Capital One Financial Corp. because it is a bank holding

company.

(3) Tier 1 common ratio is a regulatory capital measure calculated based on Tier 1 common capital divided by risk-weighted assets.

(4) Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets.

(5) Total risk-based capital ratio is a regulatory capital measure calculated based on total risk-based capital divided by risk-weighted assets.

(6) Tier 1 leverage ratio is calculated based on Tier 1 capital divided by quarterly average total assets, after certain adjustments.

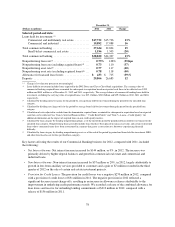

We exceeded minimum capital requirements and would meet the “well capitalized” ratio levels specified under

prompt corrective action for Tier 1 risk-based capital, total risk-based capital and Tier 1 leverage under Federal

Reserve capital standards for bank holding companies as of December 31, 2012. The Banks also exceeded

minimum regulatory requirements under the OCC’s applicable capital adequacy guidelines and were “well

capitalized” under prompt corrective action requirements as of December 31, 2012.

On October 17, 2012, the OCC approved, subject to several conditions, CONA’s application to merge with ING

Bank with CONA surviving the merger. In addition, the OCC approved CONA’s companion application to

reduce capital surplus, which was necessary to manage excess capital levels that would result from the merger.

CONA effected the reduction in surplus through a return of capital to Capital One immediately prior to the

merger. Capital One effected the merger on November 1, 2012. The merger and reduction in CONA’s capital

surplus had no effect on Capital One’s total capital.

Recent Developments in Capital and Liquidity Requirements

As of December 31, 2012, we had outstanding trust preferred securities with a combined aggregate principal

amount of $3.65 billion that previously qualified as Tier 1 capital. On January 2, 2013, we redeemed all of our

outstanding trust preferred securities, which generally carried a higher coupon cost, ranging from 3.36% to

10.25%, than other funding sources available to us. Pursuant to the Dodd-Frank Act, the Tier 1 capital treatment

of trust preferred securities is to be phased out over a three year period starting on January 1, 2013.

In June 2012, the Federal Reserve, OCC and FDIC released proposed rules that would increase the general risk-

based capital ratio minimum requirements, modify the definition of regulatory capital, establish a minimum Tier

87