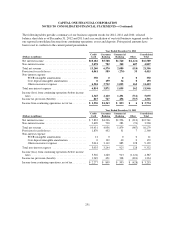

Capital One 2012 Annual Report Download - page 272

Download and view the complete annual report

Please find page 272 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

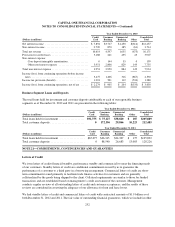

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

liabilities in our consolidated balance sheets, was $4 million as of December 31, 2012. These financial

guarantees had expiration dates ranging from 2012 to 2023 as of December 31, 2012.

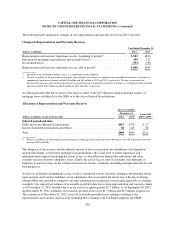

Contingent Payments Related to Acquisitions and Partnership Agreements

Certain of our acquisition and partnership agreements include contingent payment provisions in which we agree

to provide future payments, up to a maximum amount, based on certain performance criteria. Our contingent

payment arrangements are generally based on the difference between the expected credit performance of

specified loan portfolios as of the date of the applicable agreement and the actual future performance. To the

extent that actual losses associated with these portfolios are less than the expected level, we agree to share a

portion of the benefit with the seller. The maximum contingent payment amount related to our acquisitions

totaled $165 million as of December 31, 2012. The actual payment amount related to $30 million of this balance

will be determined as of September 30, 2013. The actual payment amount related to the remaining $135 million

of this balance was determined as of December 31, 2012. We recognized an expense related to contingent

payment arrangements of $77 million during 2012. As such, we had a liability for contingent payments related to

these arrangements of $165 million and $88 million as of December 31, 2012 and 2011, respectively. On

January 4, 2013, we settled one of our existing contingent payment arrangements for $135 million.

Guarantees

We have credit exposure on agreements that we entered into to manage our risk of loss on certain manufactured

housing securitizations issued by GPC in 2000. Our maximum credit exposure related to these agreements totaled

$19 million and $23 million as of December 31, 2012 and 2011, respectively. These agreements are recorded in

our consolidated balance sheets as a component of other liabilities. The value of our obligations under these

agreements was $17 million and $12 million as of December 31, 2012 and 2011, respectively. See “Note 7—

Variable Interest Entities and Securitizations” for additional information about our manufactured housing

securitization transactions.

Payment Protection Insurance

In the U.K., we previously sold payment protection insurance (“PPI”). In response to an elevated level of

customer complaints across the industry, heightened media coverage and pressure from consumer advocacy

groups, the U.K. Financial Services Authority (“FSA”) investigated and raised concerns about the way some

companies have handled complaints related to the sale of these insurance policies. In connection with this matter,

we have established a reserve related to PPI, which totaled $220 million as of December 31, 2012.

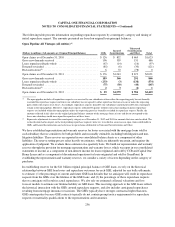

Potential Mortgage Representation & Warranty Liabilities

In recent years, we acquired three subsidiaries that originated residential mortgage loans and sold them to various

purchasers, including purchasers who created securitization trusts. These subsidiaries are Capital One Home

Loans, which was acquired in February 2005; GreenPoint Mortgage Funding, Inc. (“GreenPoint”), which was

acquired in December 2006 as part of the North Fork acquisition; and CCB, which was acquired in February

2009 and subsequently merged into CONA.

In connection with their sales of mortgage loans, the subsidiaries entered into agreements containing varying

representations and warranties about, among other things, the ownership of the loan, the validity of the lien

securing the loan, the loan’s compliance with any applicable loan criteria established by the purchaser, including

underwriting guidelines and the ongoing existence of mortgage insurance, and the loan’s compliance with

applicable federal, state and local laws. The representations and warranties do not address the credit performance

253