Capital One 2012 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

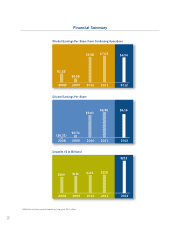

Commercial Banking delivered net income

of $835 million in 2012. Charge-offs declined

to 0.12%, driven by conservative origination

standards and higher net recoveries from

previous losses. Overall revenue grew by

11%, with loan growth of 13%, fairly stable loan

yields, and 20% growth in non-interest income.

We are simultaneously delivering

two well-managed integrations

In 2011, Capital One announced two of the

three largest banking acquisitions since the

financial crisis, and as we headed into 2012,

delivering sure-footed integrations was a top priority. The work required to

achieve the integrations is massive, affecting every business and functional

unit in the company.

The integrations are going very well. There has been minimal operational,

customer, or associate disruption. Both integrations are on track, integration

costs are on budget, and we’re achieving synergies in line with our expectations.

Our primary concern for the ING Direct integration was to protect and

preserve the unique and beloved customer experience and deep customer

loyalty that ING Direct had created over more than a decade. We also

focused on maintaining the culture and sense of mission that enables ING

Direct associates to deliver a great customer experience. These efforts

are paying off. ING Direct customer attrition and balances have remained

stable, and Capital One has successfully brought on board more than

2,000 ING Direct associates. Even with the significant changes resulting from the merger, ING Direct associate

morale and engagement are already comparable to the rest of the company.

On February 1, 2013, we launched our new Direct Banking brand – Capital One 360. We rebranded more than

3,000 customer touch points. While the rebranding efforts and customer communications are going well, our work

is not done. We remain fully mobilized to ensure that the ING Direct culture and customer experience flourish and

grow inside Capital One.

The big focus of the HSBC U.S. credit card business integration has been to disentangle the systems and

operations of that business from the parent company and integrate them with Capital One’s infrastructure.

Commercial Banking Group

Not-For-Profi t Banking

Products and services offered by Capital One, N.A., Member FDIC. © 2012 Capital One.

Capital One is a federally registered service mark. All rights reserved.

Our Not-For-Profi t Relationship Team brings a depth of industry experience to our clients,

as well as a commitment to both their mission and the communities they serve. As a top-10

U.S. bank, we deliver a full suite of products and services, including treasury management,

credit and investment solutions, that sets your organization leagues ahead.

Kathleen Malloy kathleen.malloy@capitalone.com (202) 942-2916

Commercial Banking Group

Energy Banking

Capital O ne Southc oast, Inc. is a wholly owne d non-bank subsidiary of Capit al One F inancial Corpo ration. All securities products and ser vices are offered by Capi tal

One South coast, Inc. C apital One S outhcoa st, Inc. is a memb er of FINRA and SIPC. The secur ities sol d, offered, o r recommend ed by Capit al One South coast, Inc. ar e

not insured by the FDIC or any Federal Gove rnment Agency, are not dep osits of a b ank or bank guarantee d, are subject to inves tment risk, including the risk that they

may lo se value, and are sol d or offe red sole ly by Capi tal One S outhcoa st, Inc. © 2012 C apital On e. Capit al One is a f ederally regi stere d servi ce mark. A ll right s res erved.

Power up your growth with Capital One Southcoast. Our Energy Banking team has over

200 years of combined industry experience, including equity and bond underwriting,

raising private equity capital, M&A, and other fi nancial advisory services. For trusted

advice and creative energy solutions, look no further than Capital One Southcoast.

Jim McBride

(713) 435-5338

Commercial Banking Group

Direct Municipal Lending

Products and services offered by Capital One, N.A., Member FDIC. © 2012 Capital One. Capital One is a

federally registered service mark. All rights reserved.

At Capital One Bank®

, we use our extensive knowledge of the municipal market

to help keep cities and towns moving. Our team of experts has an average of

15 years’ experience working with over 800 different governmental units. We’re

always on call, with the knowledge and expertise to help cities do great things.

Jonathan Lewis

jonathan.lewis@ capitalone.com

(631) 531-2824

Our Commercial Banking business

uses a relationship-based banking

model and deep industry specialization

to provide powerful products and

services to our customers. This strategy

helped deliver more than $800 million

in net income in 2012.