Capital One 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.1 common ratio requirement, introduce a new capital conservation buffer requirement, and update the prompt

corrective action framework to reflect the new regulatory capital minimums. For additional information on recent

developments in capital and liquidity requirements that may impact us, including Basel II and Basel III, see

“Item 1. Business—Supervision and Regulation—Capital Adequacy.”

In November 2011, the Federal Reserve finalized capital planning rules applicable to large bank holding

companies like us (commonly referred to as Comprehensive Capital Analysis and Review or CCAR). Under the

rules, bank holding companies with consolidated assets of $50.0 billion or more must submit capital plans to the

Federal Reserve on an annual basis and must obtain approval from the Federal Reserve before making most

capital distributions. The purpose of the rules is to ensure that large bank holding companies have robust,

forward-looking capital planning processes that account for their unique risks and capital needs to continue

operations through times of economic and financial stress. As part of its evaluation of a capital plan, the Federal

Reserve will consider the comprehensiveness of the plan, the reasonableness of assumptions and analysis and

methodologies used to assess capital adequacy, and the ability of the bank holding company to maintain capital

above each minimum regulatory capital ratio and above a Tier 1 common ratio of 5% on a pro forma basis under

both expected and stressful conditions throughout a planning horizon of at least nine quarters.

We submitted a Comprehensive Capital Analysis and Review (“CCAR 2013”) to the Federal Reserve on

January 7, 2013 along with eighteen other large U.S. banking organizations. We expect to incorporate any

feedback from our regulators in response to the CCAR 2013 submission in our ongoing capital management

planning. Any proposed dividend increase or other capital action must be approved as a part of CCAR.

Dividend Policy

We paid common stock dividends of $0.05 per share each quarter in 2012. On January 31, 2013, our Board of

Directors declared a quarterly dividend of $0.05 per share, payable February 22, 2013 to stockholders of record

as of February 11, 2013, and a quarterly dividend on the outstanding shares of our 6.00% fixed rate non-

cumulative perpetual preferred stock, Series B (the “Series B Preferred Stock”). Each outstanding share of the

Series B Preferred Stock is represented by depositary shares, each representing a 1/40th interest in a share of

Series B Preferred Stock. The dividend of $15.00 per share (equivalent to $0.375 per outstanding depositary

share) will be paid on March 1, 2013 to stockholders of record at the close of business on February 14, 2013.

The declaration and payment of dividends to our stockholders, as well as the amount thereof, are subject to the

discretion of our Board of Directors and depend upon our results of operations, financial condition, capital levels,

cash requirements, future prospects and other factors deemed relevant by the Board of Directors. As a bank

holding company, our ability to pay dividends is largely dependent upon the receipt of dividends or other

payments from our subsidiaries. For additional information on dividends, see “Item 1. Business—Supervision

and Regulation—Dividends, Stock Purchases and Transfer of Funds.”

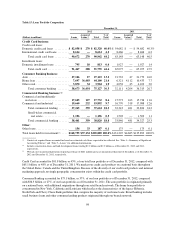

Regulatory restrictions exist that limit the ability of the Banks to transfer funds to our bank holding company.

Funds available for dividend payments from COBNA and CONA were $3.3 billion and $1.9 billion, respectively,

as of December 31, 2012. Applicable provisions that may be contained in our borrowing agreements or the

borrowing agreements of our subsidiaries may limit our subsidiaries’ ability to pay dividends to us or our ability

to pay dividends to our stockholders. See “Equity and Debt Offerings and Transactions” for more information.

There can be no assurance that we will declare and pay any dividends.

Equity and Debt Offerings and Transactions

On February 16, 2012, we settled forward sale agreements that we entered into with certain counterparties acting

as forward purchasers in connection with a public offering of shares of our common stock on July 19, 2011.

88