Capital One 2012 Annual Report Download - page 138

Download and view the complete annual report

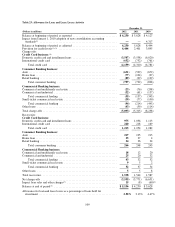

Please find page 138 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Market Risk Measurement

We have prescribed risk management policies and limits established by our Asset/Liability Management

Committee and approved by the Finance Committee of the Board. Our objective is to manage our asset/liability

risk position and exposure to market risk in accordance with these policies and prescribed limits based on

prevailing market conditions and long-term expectations. Because no single measure can reflect all aspects of

market risk, we use various industry standard market risk measurement techniques and analyses to measure,

assess and manage the impact of changes in interest rates and foreign exchange rates on our earnings and the

economic value of equity.

We consider the impact on both earnings and economic value of equity in measuring and managing our interest

rate risk. Our earnings sensitivity measure estimates the impact on net interest income and the valuation of our

mortgage servicing rights, including derivative hedging activity, resulting from movements in interest rates. Our

economic value of equity sensitivity measure estimates the impact on the net present value of our assets and

liabilities, including derivative hedging activity, resulting from movements in interest rates. Our economic value

of equity sensitivity measurements are based on our existing assets and liabilities, including derivatives, and do

not incorporate business growth assumptions or projected plans for funding mix changes.

The federal funds rate remained at a target range of zero to 0.25% during 2012. Given the level of short-term

rates as of December 31, 2012 and 2011, a scenario where interest rates would decline by 200 basis points is not

plausible. In 2008, we temporarily revised our customary declining interest rate scenario of 200 basis points to a

50 basis point decrease, except in scenarios where a 50 basis point decline would result in a rate less than 0% (in

which case we assume a rate scenario of 0%), to compensate for the continued low rate environment. Our current

asset/liability management policy also includes the use of derivatives to hedge material foreign currency

denominated transactions to limit our earnings exposure to foreign exchange risk.

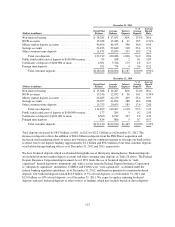

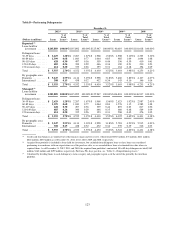

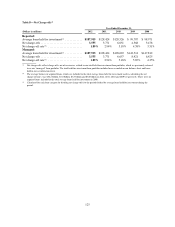

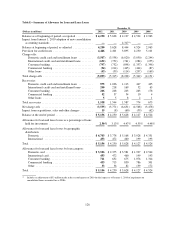

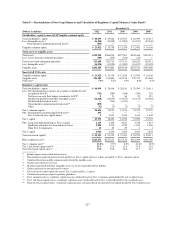

Table 32 shows the estimated percentage impact on our adjusted projected net interest income and economic

value of equity, calculated under alternative hypothetical interest rate scenarios, as of December 31, 2012 and

2011. Our adjusted projected net interest income consists of net interest income adjusted to include changes in

the fair value of mortgage servicing rights, including related derivative hedging activity, and changes in the fair

value of free-standing interest rate swaps. In measuring the sensitivity of interest rate movements on our adjusted

projected net interest income, we assume a hypothetical gradual increase in interest rates of 200 basis points and

a hypothetical gradual decrease of 50 basis points relative to implied forward rates over the next twelve months.

In measuring the sensitivity of interest rate movements on our economic value of equity, we assume a

hypothetical instantaneous parallel shift in the level of interest rates of plus 200 basis points and minus 50 basis

points to spot rates.

We recently revised two assumptions used to calculate our earnings sensitivity measures. First, in addition to our

existing assets and liabilities, we now incorporate expected future business growth assumptions, such as loan and

deposit growth and pricing, and plans for projected changes in our funding mix in our baseline forecast. Second,

we changed the interest rate scenario used to measure and evaluate the impact on the baseline forecast to assess

our earnings sensitivity. We previously measured our earnings sensitivity assuming a gradual plus or minus 200

basis point change in forward rates. Our assumption is now based on an instantaneous plus or minus 200 basis

point shock as described above, with the lower rate scenario limited to zero. We will continue to factor into our

interest rate risk management decisions the potential impact of alternative interest rate scenarios, such as stressed

rate shocks as well as steepening and flattening yield curve scenarios, for all of sensitivity measures.

Table 32 includes our earnings sensitivity as of December 31, 2012 based on our revised methodology, as well as

our previous methodology. Our revised methodology results in a slightly higher asset sensitivity position, which

is attributable to a higher forecasted volume of rate sensitive assets versus rate sensitive liabilities and the impact

of a more severe instantaneous shock. We have not revised our methodology for measuring our economic value

of equity sensitivities. Accordingly, the economic value sensitivity measures presented under our revised

methodology are the same as those presented under our previous methodology.

119