Capital One 2012 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311

|

|

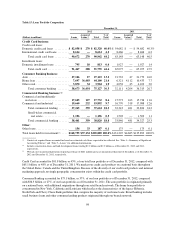

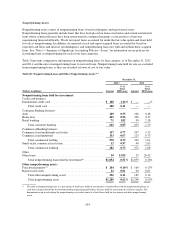

Table 15: Loan Portfolio Composition

December 31,

(Dollars in millions)

2012 2011

Loans

Acquired

Loans(1) Total

% of

Total Loans

Acquired

Loans(1) Total

% of

Total

Credit Card business:

Credit card loans:

Domestic credit card loans ..........$ 82,058 $ 270 $ 82,328 40.0%$ 54,682 $ — $ 54,682 40.3%

International credit card loans ........ 8,614 — 8,614 4.2 8,466 — 8,466 6.2

Total credit card loans .......... 90,672 270 90,942 44.2 63,148 — 63,148 46.5

Installment loans:

Domestic installment loans .......... 795 18 813 0.4 1,927 — 1,927 1.4

Total credit card ............... 91,467 288 91,755 44.6 65,075 — 65,075 47.9

Consumer Banking business:

Auto ............................ 27,106 17 27,123 13.2 21,732 47 21,779 16.0

Home loan ....................... 7,697 36,403 44,100 21.4 6,321 4,112 10,433 7.7

Other retail ....................... 3,870 34 3,904 1.9 4,058 45 4,103 3.0

Total consumer banking ........ 38,673 36,454 75,127 36.5 32,111 4,204 36,315 26.7

Commercial Banking business:(2)

Commercial and multifamily

real estate ...................... 17,605 127 17,732 8.6 15,573 163 15,736 11.6

Commercial and industrial .......... 19,660 232 19,892 9.7 16,770 318 17,088 12.6

Total commercial lending ....... 37,265 359 37,624 18.3 32,343 481 32,824 24.2

Small-ticket commercial

real estate .................. 1,196 — 1,196 0.5 1,503 — 1,503 1.1

Total commercial banking ....... 38,461 359 38,820 18.8 33,846 481 34,327 25.3

Other:

Other loans ....................... 154 33 187 0.1 175 — 175 0.1

Total loans held for investment(3) .....$168,755 $37,134 $205,889 100.0%$131,207 $4,685 $135,892 100.0%

(1) Consists of acquired loans accounted for based on estimated cash flows expected to be collected. See “Note 1—Summary of Significant

Accounting Policies” and “Note 5—Loans” for additional information.

(2) Includes construction loans and land development loans totaling $2.1 billion and $2.2 billion as of December 31, 2012 and 2011,

respectively.

(3) We had a net unamortized premium on purchased loans of $461 million and a net unamortized discount of $4 million as of December 31,

2012 and December 31, 2011, respectively.

Credit Card accounted for $91.8 billion, or 45%, of our total loan portfolio as of December 31, 2012, compared with

$65.1 billion, or 48% as of December 31, 2011. We market our credit card products on a national basis throughout

the United States, Canada and the United Kingdom. Because of the diversity of our credit card products and national

marketing approach, no single geographic concentration exists within the credit card portfolio.

Consumer Banking accounted for $75.1 billion, or 37%, of our loan portfolio as of December 31, 2012, compared

with $36.3 billion, or 27%, of our loan portfolio as of December 31, 2011. The auto portfolio is originated primarily

on a national basis, with additional originations through our retail branch network. The home loan portfolio is

concentrated in New York, California and Louisiana which reflects the characteristics of the legacy Hibernia,

North Fork and Chevy Chase Bank portfolios that comprise the majority of our home loans. Retail banking includes

small business loans and other consumer lending products originated through our branch network.

98