Capital One 2012 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have established representation and warranty reserves for losses associated with the mortgage loans sold by

each subsidiary that we consider to be both probable and reasonably estimable, including both litigation and non-

litigation liabilities. These reserves are reported in our consolidated balance sheets as a component of other

liabilities. The reserve setting process relies heavily on estimates, which are inherently uncertain, and requires the

application of judgment. We evaluate these estimates on a quarterly basis. We build our representation and

warranty reserves through the provision for mortgage representation and warranty losses, which we report in our

consolidated statements of income as a component of non-interest income for loans originated and sold by CCB

and Capital One Home Loans and as a component of discontinued operations for loans originated and sold by

GreenPoint. In establishing the representation and warranty reserves, we consider a variety of factors depending

on the category of purchaser.

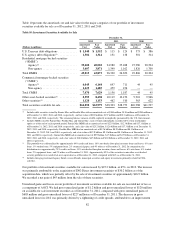

The aggregate reserves for all three subsidiaries totaled $899 million as of December 31, 2012, compared with

$919 million as of September 30, 2012, and $943 million as of December 31, 2011. The decrease in the reserve

in 2012 was driven primarily by the settlement of claims.

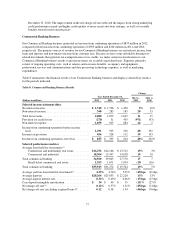

The table below summarizes changes in our representation and warranty reserves in 2012 and 2011.

Table 13: Changes in Representation and Warranty Reserve

Year Ended December 31,

(Dollars in millions) 2012 2011

Representation and warranty repurchase reserve, beginning of period(1) .............. $ 943 $816

Provision for mortgage representation and warranty losses(2) ...................... 349 212

Net realized losses ........................................................ (393) (85)

Representation and warranty repurchase reserve, end of period(1) ................... $ 899 $943

(1) Reported in our consolidated balance sheets as a component of other liabilities.

(2) The pre-tax portion of the provision for mortgage representation and warranty losses recognized in our consolidated statements of

income as a component of non-interest income totaled $42 million and $43 million in 2012 and 2011, respectively. The pre-tax portion of

the provision for mortgage representation and warranty losses recognized in our consolidated statements of income as a component of

discontinued operations totaled $307 million and $169 million in 2012 and 2011, respectively.

We provide additional information related to the representation and warranty reserve, including factors that may

impact the adequacy of the reserves and the ultimate amount of losses incurred by our subsidiaries, above in

“Critical Accounting Policies and Estimates—Representation and Warranty Reserve” and in “Note 21—

Commitments, Contingencies and Guarantees.”

OFF-BALANCE SHEET ARRANGEMENTS AND VARIABLE INTEREST ENTITIES

In the ordinary course of business, we are involved in various types of arrangements with limited liability

companies, partnerships or trusts that often involve special purpose entities and variable interest entities

(“VIEs”). Some of these arrangements are not recorded on our consolidated balance sheets or may be recorded in

amounts different from the full contract or notional amount of the arrangements, depending on the nature or

structure of, and accounting required to be applied to, the arrangement. These arrangements may expose us to

potential losses in excess of the amounts recorded in the consolidated balance sheets. Our involvement in these

arrangements can take many forms, including securitization and servicing activities, the purchase or sale of

mortgage-backed or other asset-backed securities in connection with our home loan portfolio and loans to VIEs

that hold debt, equity, real estate or other assets.

Our continuing involvement in unconsolidated VIEs primarily consists of interests in certain mortgage loan trusts

and community reinvestment and development entities. The carrying amount of assets and liabilities of these

85