Capital One 2012 Annual Report Download - page 103

Download and view the complete annual report

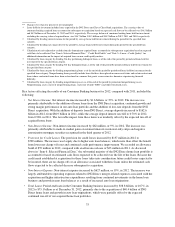

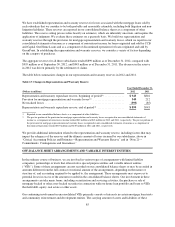

Please find page 103 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Period-end loans held for investment increased by $70.0 billion, or 52%, in 2012 to $205.9 billion as of

December 31, 2012. The increase was primarily attributable to the addition of the acquired ING Direct loan

portfolio of $40.4 billion and receivables acquired in the 2012 U.S. card acquisition of $27.8 billion, each

designated as held for investment. Excluding the impact of these loans, period-end loans held for investment

increased by $1.8 billion, or 1%. This increase reflected commercial loan growth and continued growth in auto

loans, which was partially offset by the continued expected run-off of loans in businesses we exited or

repositioned, other loan pay downs and charge-offs. The run-off portfolios include installment loans in our Credit

Card business, home loans in our Consumer Banking business and small-ticket commercial real estate loans in

our Commercial Banking business. The run-off of home loans has accelerated slightly as a result of the low

mortgage interest rate environment. We provide additional information on the composition of our loan portfolio

and credit quality below in “Credit Risk Profile” and in “Note 5—Loans.”

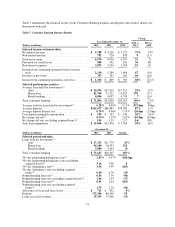

Customer Deposits

Our customer deposits have become our largest source of funding for our operations and asset growth, providing

a sizeable and consistent source of low-cost funds. Total customer deposits increased by $84.3 billion, or 66%, in

2012, to $212.5 billion as of December 31, 2012, from $128.2 billion as of December 31, 2011. The increase in

deposits reflects the addition of $84.4 billion in deposits from the ING Direct acquisition and increased retail

marketing efforts to attract new business and our continued strategy to leverage our bank outlets to attract lower

cost deposit funding. We provide information on the composition of our deposits, average outstanding balances,

interest expense and yield below in “Liquidity Risk Profile.”

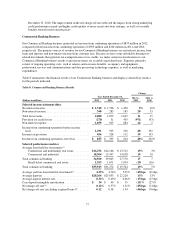

Securitized Debt Obligations

Borrowings owed to securitization investors decreased by $5.1 billion to $11.4 billion as of December 31, 2012,

from $16.5 billion as of December 31, 2011. The decrease was attributable to the scheduled maturities of the debt

within our credit card securitization trusts.

Other Debt

Other debt includes federal funds purchased and securities loaned or sold under agreements to repurchase, senior

and subordinated notes and other borrowings, including junior subordinated debt and Federal Home Loan Bank

(“FHLB”) advances. Other debt totaled $38.5 billion as of December 31, 2012, of which $21.1 billion

represented short-term borrowings and $17.4 billion represented long-term borrowings. Other debt totaled

$23.0 billion as of December 31, 2011, of which $7.3 billion represented short-term borrowings and $15.7 billion

represented long-term borrowings.

The increase in other debt of $15.5 billion in 2012 was primarily attributable to an increase in FHLB advances of

$14.0 billion increase, the majority of which occurred in the fourth quarter of 2012, to meet seasonal loan

growth, fund an increase in our investment securities and cover the withdrawal of a portion of the holding

company’s deposits at our banking subsidiaries in anticipation of the January 2, 2013 redemption of the $3.65

billion of trust preferred securities. We provide additional information on our borrowings in “Note 10—Deposits

and Borrowings.”

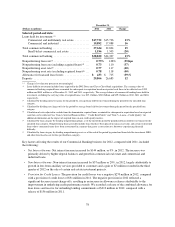

Potential Mortgage Representation & Warranty Liabilities

In recent years, we acquired three subsidiaries that originated residential mortgage loans and sold them to various

purchasers, including purchasers who created securitization trusts. These subsidiaries are Capital One Home

Loans, which was acquired in February 2005; GreenPoint Mortgage Funding, Inc. (“GreenPoint”), which was

acquired in December 2006 as part of the North Fork acquisition; and Chevy Chase Bank, which was acquired in

February 2009 and subsequently merged into CONA.

84