Capital One 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

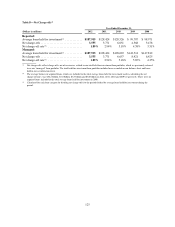

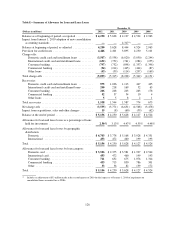

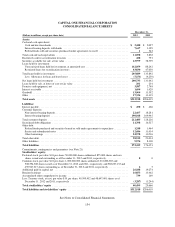

Table F— Reconciliation of Non-Gaap Measures and Calculation of Regulatory Capital Measures Under Basel I

December 31,

(Dollars in millions) 2012 2011 2010 2009 2008

Stockholders’ equity to non-GAAP tangible common equity

Total stockholders’ equity .................................. $ 40,499 $ 29,666 $ 26,541 $ 26,590 $ 26,611

Less: Intangible assets(1) ................................... (16,224) (13,908) (13,983) (14,107) (12,445)

Noncumulative perpetual preferred stock(2) ................ (853) ————

Tangible common equity ................................... $ 23,422 $ 15,758 $ 12,558 $ 12,483 $ 14,166

Total assets to tangible assets

Total assets ............................................. $312,918 $206,019 $197,503 $169,646 $165,913

Less: Assets from discontinued operations ..................... (309) (305) (362) (24) —

Total assets from continuing operations ....................... 312,609 205,714 197,141 169,622 165,913

Less: Intangible assets(1) ................................... (16,224) (13,908) (13,983) (14,107) (12,445)

Tangible assets .......................................... $296,385 $191,806 $183,158 $155,515 $153,468

Non-GAAP TCE ratio

Tangible common equity ................................... $ 23,422 $ 15,758 $ 12,558 $ 12,483 $ 14,166

Tangible assets .......................................... 296,385 191,806 183,158 155,515 153,468

TCE ratio(3) ............................................. 7.9% 8.2% 6.9% 8.0% 9.2%

Regulatory capital ratios

Total stockholders’ equity .................................. $ 40,499 $ 29,666 $ 26,541 $ 26,590 $ 26,611

Less: Net unrealized losses (gains) on securities available for sale

recorded in AOCI(4) .................................. (712) (289) (368) (200) 783

Net losses on cash flow hedges recorded in AOCI(4) ........ 271 86 92 215

Disallowed goodwill and other intangible assets(5) .......... (14,428) (13,855) (13,953) (14,125) (12,482)

Disallowed deferred tax assets .......................... —(534) (1,150) — —

Noncumulative perpetual preferred stock(2) ................ (853) ————

Other ............................................. (12) (2) (2) (2) (2)

Tier 1 common capital ..................................... 24,496 15,057 11,154 12,355 15,125

Plus: Noncumulative perpetual preferred stock(2) ................ 853 ————

Tier 1 restricted core capital items(6) ..................... 23,635 3,636 3,634 1,642

Tier 1 capital ............................................ 25,351 18,692 14,790 15,989 16,767

Plus: Long-term debt qualifying as Tier 2 capital ................ 2,119 2,438 2,827 3,018 1,813

Qualifying allowance for loan and lease losses ............. 2,830 1,979 3,748 1,581 1,630

Other Tier 2 components .............................. 13 23 29 4 1

Tier 2 capital ............................................ 4,962 4,440 6,604 4,603 3,444

Total risk-based capital(7) .................................. $ 30,313 $ 23,132 $ 21,394 $ 20,592 $ 20,211

Risk-weighted assets(8) .................................... $223,472 $155,657 $127,132 $116,309 $121,380

Tier 1 common ratio(9) ..................................... 11.0% 9.7% 8.8% 10.6% 12.5%

Tier 1 risk-based capital ratio(10) ............................. 11.3 12.0 11.6 13.8 13.8

Total risk-based capital ratio(11) .............................. 13.6 14.9 16.8 17.7 16.7

(1) Includes impact from related deferred taxes.

(2) Noncumulative perpetual preferred stock qualifies as Tier 1 capital; however, it does not qualify as Tier 1 common capital.

(3) Calculated based on tangible common equity divided by tangible assets.

(4) Amounts presented are net of tax.

(5) Disallowed goodwill and other intangible assets are net of related deferred tax liability.

(6) Consists primarily of trust preferred securities.

(7) Total risk-based capital equals the sum of Tier 1 capital and Tier 2 capital.

(8) Calculated based on prescribed regulatory guidelines.

(9) Tier 1 common ratio is a regulatory capital measure calculated based on Tier 1 common capital divided by risk-weighted assets.

(10) Tier 1 risk-based capital ratio is a regulatory capital measure calculated based on Tier 1 capital divided by risk-weighted assets.

(11) Total risk-based capital ratio is a regulatory capital measure calculated based on total risk-based capital divided by risk-weighted assets.

127