Capital One 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311

|

|

2

The Tier 1 Common Equity Ratio at the end of 2012 was 10.99% under Basel I capital rules. The equivalent Tier 1

Common Equity Ratio under fully phased-in Basel II/III rules is on track to reach our assumed regulatory minimum

under the new rules in 2013, years before the new requirements take effect.

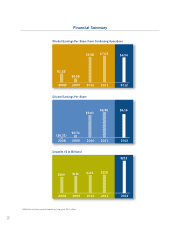

Capital One’s stock price closed the year at $57.93 per share, up 37% for the year, compared to a 30% increase in

value for the KBW Bank Index. Our Total Shareholder Return (TSR) in 2012 was 37.5%, ahead of the KBW Bank

Index TSR of 30.2%. Since we went public in November of 1994, Capital One’s TSR is approximately 1,134%,

roughly 12 times the 93.1% TSR of the KBW bank index over the same period.

Across our businesses, financial and operating performance was strong

In 2012, Domestic Card delivered $1.4 billion of net income. While below 2011 levels, 2012 net income reflects

$1.3 billion in allowance build for the acquired HSBC U.S. credit card business and $900 million in additional

merger-related impacts on both revenue and operating expense.

Our Domestic Card business is a great business, with consistently high risk-adjusted returns. We were resilient

through the Great Recession and the implementation of the CARD Act. But we face several complex challenges.

The ongoing weakness in consumer demand will constrain loan and revenue growth for some time. Our choice to

invest in franchise enhancements to deliver a great customer experience will lower the “octane” of the business to

some extent but will also help to create valuable long-term customer relationships. And new Basel II/III capital rules

will require us to allocate more capital to the Card business. All of these factors will lower bottom-line return on

equity, but we expect the returns to remain well above hurdle.

Our Consumer Banking business, which encompasses auto finance, home loans, and our retail and direct banking

businesses, delivered $1.36 billion of net income in 2012, driven by the continuing growth and profitability of our

auto finance business and strong contributions from the direct banking business we acquired from ING.

Capital One Auto Finance solidified and expanded its dealer relationships and posted solid growth and profits in 2012.

New loan originations were about $16.0 billion in 2012, up sharply from $12.5 billion in 2011. Credit losses

remained near historic lows, at about 1.7% for 2012. In 2012, competition increased significantly. Industry margins

decreased modestly and industry loan terms lengthened, particularly for prime borrowers. While we see solid

overall profitability and above-hurdle returns in new originations, we also expect that increased competition will

drive returns from current levels closer to cycle average. As competition increases, we’re keeping a close watch on

industry practices, and if they begin to impact the credit risk of new originations, we’re prepared to pull back to

protect the profitability and resiliency of our auto finance business.

Our retail banking business made improvements across all aspects of banking operations, including our branch

network, infrastructure, products, and sales and service experience. The acquisition and integration of ING Direct

gave us national reach and made Capital One the market leader in direct banking.