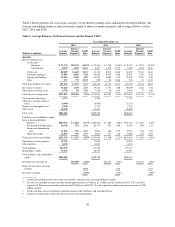

Capital One 2012 Annual Report Download - page 70

Download and view the complete annual report

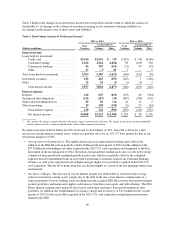

Please find page 70 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We provide additional information on the methodologies and key assumptions used in determining our allowance

for loan and lease losses for each of our loan portfolio segments in “Note 1—Summary of Significant Accounting

Policies.” We provide information on the components of our allowance, disaggregated by impairment

methodology, and changes in our allowance in “Note 6—Allowance for Loan and Lease Losses.”

Finance Charge and Fee Reserve

We recognize finance charges and fees on credit card loans as revenue when the amounts are billed to the

customer and include these amounts in the loan balance, net of the estimated uncollectible amount of billed

finance charges and fees. We continue to accrue finance charges and fees on credit card loans until the account is

charged-off; however, when we do not expect full payment of billed finance charges and fees, we reduce the

balance of our credit card loan receivables by the amount of finance charges and fees billed but not expected to

be collected and exclude this amount from revenue. Total net revenue was reduced by $937 million, $371 million

and $950 million in 2012, 2011, 2010, respectively, for the estimated uncollectible amount of billed finance

charges and fees. The finance charge and fee reserve totaled $307 million as of December 31, 2012, compared

with $74 million as of December 31, 2011.

We review and assess the adequacy of the uncollectible finance charge and fee reserve on a quarterly basis. Our

methodology for estimating the uncollectible portion of billed finance charges and fees is primarily based on the

use of a roll-rate methodology and consistent with the methodology we use to estimate the allowance for incurred

principal losses on our credit card loan receivables. Accordingly, the estimation process is subject to similar risks

and uncertainties, including a reliance on historical loss and trend information that may not be representative of

current conditions and indicative of future performance. We refine our estimation process and key assumptions

used in determining our loss reserves as additional information becomes available. Changes in key assumptions

may have a material impact on the amount of billed finance charges and fees we estimate as uncollectible in each

period. For example, in the third quarter of 2011, we revised the manner in which we estimate expected

recoveries of finance charge and fee amounts previously considered to be uncollectible. Our revised recovery

assumptions better reflected the post-recession pattern of relatively low delinquency roll-rates combined with

increased recoveries of finance charges and fees previously considered uncollectible. This change in assumptions

resulted in a reduction in our uncollectible finance charge and fee reserves of approximately $83 million and a

corresponding increase in revenues. We also applied these revised assumptions to the estimated recovery of

principal charge-offs in determining our allowance for loan and lease losses.

Asset Impairment

In addition to our loan portfolio, we review other assets for impairment on a regular basis in accordance with

applicable impairment accounting guidance. This process requires significant management judgment and

involves various estimates and assumptions. Our investment securities and goodwill and intangible assets

represent a significant portion of our other assets. Accordingly, below we describe our process for assessing

impairment of these assets and the key estimates and assumptions involved in this process.

Investment Securities

We regularly review investment securities for other-than-temporary impairment using both quantitative and

qualitative criteria. If we intend to sell a security in an unrealized loss position or it is more likely than not that

we will be required to sell the security prior to recovery of its amortized cost basis, the entire difference between

the amortized cost basis of the security and its fair value is recognized in earnings. If we do not intend to sell the

security and it is not more likely than not that we will be required to sell the security before recovery of our

amortized cost, we evaluate other qualitative criteria to determine whether a credit loss exists. Our evaluation

requires significant management judgment and a consideration of many factors, including, but not limited to, the

extent and duration of the impairment; the health of and specific prospects for the issuer, including whether the

issuer has failed to make scheduled interest or principal payments; recent events specific to the issuer and/or

51