Capital One 2012 Annual Report Download - page 281

Download and view the complete annual report

Please find page 281 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

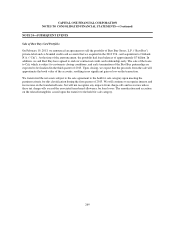

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

GreenPoint has established reserves with respect to its probable and reasonably estimable legal liability from the

U.S. Bank Lawsuit, which reserves are included within the overall representation and warranty reserve. Also as

noted above, GreenPoint has exposure to loss in excess of the amount established within the overall

representation and warranty reserve because our reserve assumes, among other things, that we will be responsible

for only a portion of the portfolio-wide losses inherent in the securitizations and sought in the lawsuit.

In September, 2010, DB Structured Products, Inc. (“DBSP”) named GreenPoint in a third-party complaint, filed

in the New York County Supreme Court, alleging breach of contract and seeking indemnification (the “DBSP

Litigation”). In the underlying suit, Assured Guaranty Municipal Corp. (“AGM”) sued DBSP for alleged

breaches of representations and warranties made by DBSP with respect to certain residential mortgage loans that

collateralize a securitization insured by AGM and sponsored by DBSP (the “Underlying Lawsuit”). DBSP

purchased the HELOC loans from GreenPoint in 2006. The entire securitization, almost all of which is insured by

AGM, is comprised of about 6,200 mortgage loans with an aggregate original principal balance of approximately

$353 million. DBSP asserts that any liability it faces lies with GreenPoint, alleging that DBSP’s representations

and warranties to AGM are substantially similar to the representations and warranties made by GreenPoint to

DBSP. GreenPoint filed a motion to dismiss the complaint in October 2010, which the court denied on July 25,

2011. The parties are currently engaged in discovery. As noted above, GreenPoint has established reserves with

respect to its estimated probable and reasonable estimable legal liability from the DBSP Litigation, which

reserves are included within the overall representation and warranty reserve. Also as noted above, GreenPoint has

exposure to loss in excess of the amount established within the overall representation and warranty reserve

because our reserve assumes, among other things, that we will be responsible for only a portion of the losses

sought in the lawsuit.

On October 24, 2012, Capital One, N.A., (“CONA”) as successor to Chevy Chase Bank, F.S.B. (“CCB”), was

named as a defendant in a lawsuit filed in the Southern District of New York by Ambac Assurance Corporation

and the Segregated Account of Ambac Assurance Corporation (the “Ambac Litigation”). Plaintiffs allege, among

other things, that CONA (as successor to CCB) breached certain representations and warranties in contracts

relating to six securitizations with an aggregate original principal balance of approximately $5.2 billion which

were sponsored by a CCB affiliate in 2006 and 2007 and backed by loans originated by CCB. Almost half of the

securities issued by the six trusts are insured by Ambac. Plaintiffs seek unspecified damages, an order compelling

CONA to indemnify Ambac for all accrued and future damages based on alleged breaches of representations and

warranties relating to a limited sampling of loans in the portfolio, the repurchase of specific mortgage loans to

which the alleged breaches of representations and warranties relate, and all related fees, costs, and interest.

CONA moved to dismiss the complaint on January 14, 2013. As noted above, CONA has established reserves

with respect to its probable and reasonably estimable legal liability from the Ambac Litigation, which reserves

are included within the overall representation and warranty reserve. Also as noted above, CONA has exposure to

loss in excess of the amount established within the overall representation and warranty reserve because our

reserve assumes, among other things, that we will be responsible for only a portion of the alleged losses sought in

the lawsuit.

On May 30, June 29, and July 30, 2012, FHFA (acting as conservator for Freddie Mac) filed three summons with

notice in the New York state court against GreenPoint, on behalf of the trustees for three RMBS trusts backed by

9,594 loans originated by GreenPoint (the “FHFA Litigation”) with an aggregate original principal balance of

$3.4 billion. On January 25, 2013, the plaintiffs filed an amended complaint in the name of the three trusts, acting

by the respective trustees, alleging breaches of contractual representations and warranties regarding compliance

with GreenPoint underwriting guidelines relating to 1,808 loans. Plaintiffs seek specific performance of the

repurchase obligations with respect to the 1,808 loans for which they have provided notice of alleged breaches as

well as all other allegedly breaching loans, rescissory damages, indemnification, costs and interest.

262