Capital One 2012 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

2012 U.S. Card Acquisition

On May 1, 2012, we completed the previously announced acquisition of assets and assumption of liabilities of

the credit card and private label credit card business in the United States (other than the HSBC Bank USA,

National Association consumer credit card program and certain other retained assets and liabilities) of HSBC

Finance Corporation, HSBC USA Inc. and HSBC Technology & Services (USA) Inc. (collectively, the “HSBC

Sellers”), pursuant to the Purchase and Assumption Agreement, dated as of August 10, 2011 by and among

Capital One and each of the HSBC Sellers (the “2012 U.S. card acquisition”). We acquired approximately

$28.3 billion of outstanding credit card receivables as well as $327 million in other net assets in exchange for

consideration of approximately $31.1 billion in cash to the HSBC Sellers, net of a $252 million receivable. We

financed the acquisition through a combination of existing cash, cash acquired from the ING Direct acquisition,

the sale of securities held as available-for-sale, as well as the public debt and equity offerings described below.

The 2012 U.S. card acquisition enhanced the existing franchise and scale in the Domestic Card business and

accelerated our achievement of a leading position in retail credit card partnerships.

In the first quarter of 2012, we closed a public offering of 24,442,706 shares of our common stock which we sold

to the underwriters at a per share price of $51.14 for net proceeds of approximately $1.25 billion. In addition, we

issued $1.25 billion of our senior notes due 2015 in a public offering which also closed in the first quarter for net

proceeds of approximately $1.25 billion. Direct costs of approximately $2 million paid to third parties in

connection with this debt issuance were capitalized as deferred charges in the balance sheet and are amortized

over the term of the debt as a component of interest expense using the effective interest method.

We also incurred transaction costs related to the 2012 U.S. card acquisition totaling $43 million as of

December 31, 2012 of which all but $3 million was recognized and reported in our 2012 consolidated statement

of income as a component of non-interest expense. These costs do not include other merger-related expenses

such as integration costs.

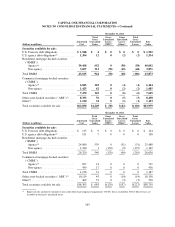

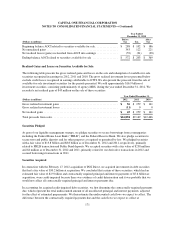

Accounting for the 2012 U.S. Card Acquisition

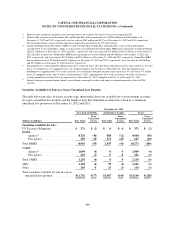

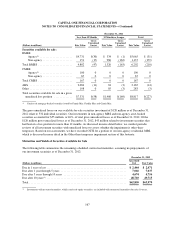

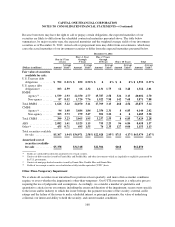

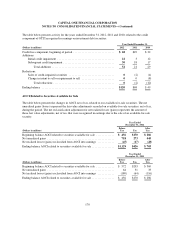

The 2012 U.S. card acquisition was accounted for under the acquisition method of accounting, which requires,

among other things, that we allocate the purchase price to the assets acquired and liabilities assumed based on

their fair values as of the acquisition date. The following table summarizes the final accounting for the 2012 U.S.

card acquisition, which is based on fair value assessments recorded in the second quarter along with fair value

adjustments recorded during the measurement period. Adjustments recorded through the end of the measurement

period on September 30, 2012 resulted in the following: a $21 million decrease in other assets, a net decrease of

$1 million in intangible assets and a net $10 million increase in other liabilities. Together, these adjustments

resulted in an increase of $32 million to the preliminary goodwill recognized as of the acquisition date.

As presented below, the purchase price of assets acquired and liabilities assumed exceeded the fair value of these

items and resulted in the recognition of $304 million of goodwill which was assigned to our Credit Card segment.

Goodwill resulted from expertise gained through an enhanced retail partnership business as well as economies of

scale obtained through infrastructure enhancements and additions to our current staff. For tax reporting purposes,

the 2012 U.S. card acquisition was treated as a taxable purchase of assets. As such, the total amount of goodwill

recognized is amortizable for tax purposes over 15 years.

161