Capital One 2012 Annual Report Download - page 113

Download and view the complete annual report

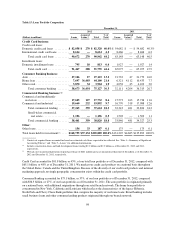

Please find page 113 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Primary Risk Categories

Below we provide an overview of how we manage our eight primary risk categories. Following this section, we

provide detailed information and metrics about three of our most significant risk exposures: credit, liquidity and

market.

Credit Risk Management

The Chief Risk Officer, in conjunction with the Consumer and Commercial Chief Credit Officers, is responsible

for establishing credit risk policies and procedures, including underwriting and hold guidelines and credit

approval authority, and monitoring credit exposure and performance of our lending-related transactions. These

responsibilities are fulfilled by the Chief Consumer Credit Officer and the Chief Commercial Credit Officer.

Division Presidents are responsible for managing the credit risk within their division and maintaining processes

to control credit risk and comply with credit policies and guidelines. In addition, the Chief Risk Officer

establishes policies, delegates approval authority and monitors performance for non-loan credit exposure entered

into with financial counterparties or through the purchase of credit sensitive securities in our investment

portfolio.

Our credit policies establish standards in five areas: customer selection, underwriting, monitoring, remediation,

and portfolio management. The standards in each area provide a framework comprising specific objectives and

control processes. These standards are supported by detailed policies and procedures for each component of the

credit process. Starting with customer selection, our goal is to generally provide credit on terms that generate

above hurdle returns. We use a number of quantitative and qualitative factors to manage credit risk, including

setting credit risk limits and guidelines for each of our lines of business. We monitor performance and forecasts

relative to these guidelines and report results and any required mitigating actions to the Credit Policy Committee

and to the Audit and Risk Committee of the Board.

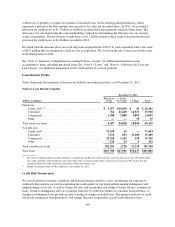

Liquidity Risk Management

The Chief Financial Officer is responsible for managing liquidity risk. We assess liquidity strength by evaluating

several different balance sheet metrics under severe stress scenarios to ensure we can withstand significant

funding degradation in both deposits and capital marketing funding sources. Management reports liquidity

metrics to the Asset/Liability Management Committee monthly and to the Finance and Trust Oversight

Committee of the Board of Directors no less than quarterly. Any policy breach in a liquidity limit will result in

the activation of the Liquidity Contingency Funding Plan and is required to be reported to the Treasurer as soon

as it is identified and to the Asset/Liability Management Committee within 48 hours. Detailed processes,

requirements and controls are contained in our policies and supporting procedures. We continuously monitor

market and economic conditions to evaluate emerging stress conditions with assessment and appropriate action

plans in accordance with our Liquidity Contingency Plan.

Market Risk Management

The Chief Financial Officer is responsible for managing market risk. We manage market risk exposure centrally

and establish quantitative limits to control our exposure. We define market risk as the risk that our earnings and/

or economic value of equity may be adversely affected by changes in market conditions, including changes in

interest rates and foreign currency exchange rates, changes in credit spreads and price fluctuations and changes in

value due to changes in market perception or the actual credit quality of issuers. Market risk is inherent in the

financial instruments associated with our operations and activities, including loans, deposits, securities, short-

term borrowings, long-term debt and derivatives.

The market risk positions of our banking entities and our total company are calculated separately and in total and

are reported in comparison to pre-established limits to the Asset/Liability Management Committee monthly and

94