Capital One 2012 Annual Report Download - page 264

Download and view the complete annual report

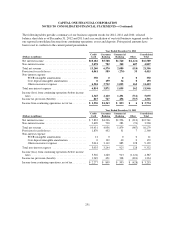

Please find page 264 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

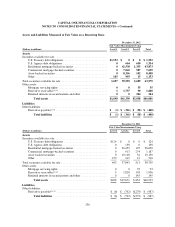

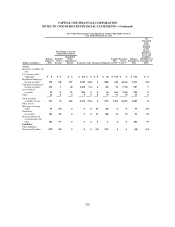

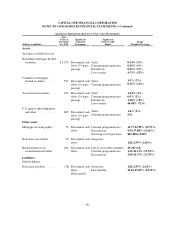

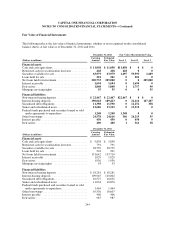

The following describes the valuation techniques used in estimating the fair value of our financial instruments as

of December 31, 2012 and 2011. We applied the fair value provisions,to the financial instruments not recognized

on the consolidated balance sheet at fair value, which include loans held for investment, interest receivable, non-

interest bearing and interest bearing deposits, other borrowings, senior and subordinated notes, and interest

payable. The provisions requiring us to maximize the use of observable inputs and to measure fair value using a

notion of exit price were factored into our selection of inputs of our established valuation techniques.

Financial Assets

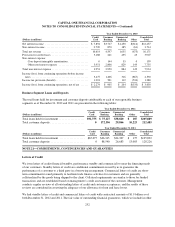

Cash and Cash Equivalents

The carrying amounts of cash and due from banks, federal funds sold and securities purchased under agreements

to resell and interest-bearing deposits with banks approximate fair value.

Restricted Cash for Securitization Investors

The carrying amounts of restricted cash for securitization investors approximate their fair value due to their

relatively short-term nature.

Securities Available For Sale

Quoted prices in active markets are used to measure the fair value of U.S. Treasury securities. For other

investment categories, we utilize multiple third-party pricing services to obtain fair value measures for the large

majority of our securities. A pricing service may be considered as the primary pricing provider for certain types

of securities, and the designation of the primary pricing provider may vary depending on the type of securities.

The determination of the primary pricing provider is based on our experience and validation benchmark of the

pricing service’s performance in terms of providing fair value measurement for the various types of securities.

Certain securities available for sale are classified as Level 2 and 3, the majority of which are collateralized

mortgage obligations and mortgage-backed securities. Level 2 and 3 classifications indicate that significant

valuation assumptions are not consistently observable in the market. When significant assumptions are not

consistently observable, fair values are derived using the best available data. Such data may include quotes

provided by a dealer, the use of external pricing services, independent pricing models, or other model-based

valuation techniques such as calculation of the present values of future cash flows incorporating assumptions

such as benchmark yields, spreads, prepayment speeds, credit ratings, and losses. The techniques used by the

pricing services utilize observable market data to the extent available. Pricing models may be used, which can

vary by asset class and may incorporate available trade, bid and other market information. Across asset classes,

information such as trader/dealer input, credit spreads, forward curves, and prepayment speeds are used to help

determine appropriate valuations. Because many fixed income securities do not trade on a daily basis, the

evaluated pricing applications may apply available information through processes such as benchmarking curves,

like securities, sector groupings, and matrix pricing to prepare valuations. In addition, model processes are used

by the pricing services to develop prepayment and interest rate scenarios.

We validate the pricing obtained from the primary pricing providers through comparison of pricing to additional

sources, including other pricing services, dealer pricing indications in transaction results, and other internal

sources. Pricing variances among different pricing sources are analyzed and validated. Additionally, on an on-

going basis we may select a sample of securities and test the third-party valuation by obtaining more detailed

information about the pricing methodology, sources of information, and assumptions used to value the securities.

245