Capital One 2012 Annual Report Download - page 118

Download and view the complete annual report

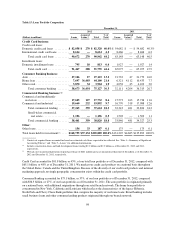

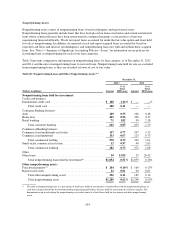

Please find page 118 of the 2012 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commercial Banking represented $38.8 billion, or 19%, of our loan portfolio as of December 31, 2012,

compared with $34.3 billion, or 25%, as of December 31, 2011. We operate our Commercial Banking business

primarily in geographic regions where we maintain retail bank branches. Accordingly, the portfolio is

concentrated in New York, Louisiana and Texas, which represent our largest retail banking markets. Our small-

ticket commercial real estate portfolio, which was originated on a national basis through a broker network, is in a

run-off mode.

We provide additional information on the geographic concentration, by loan category, of our loan portfolio in

“Note 5—Loans.”

Loans Acquired

As noted above, our portfolio of loans held for investment consists of loans acquired in the Chevy Chase Bank,

ING Direct and 2012 U.S. card acquisitions. These loans were recorded at fair value as of the date of each

acquisition. We elect to account for all purchased loans using the guidance for accounting for purchased credit-

impaired loans, which is based on expected cash flows, unless specifically scoped out of the guidance.

Loans Acquired and Accounted for Based on Expected Cash Flows

We use the term “acquired loans” to refer to a limited portion of the credit card loans acquired in the 2012 U.S.

card acquisition and the substantial majority of consumer and commercial loans acquired in the ING Direct and

Chevy Chase Bank acquisitions, which are accounted for based on expected cash flows to be collected. Acquired

loans accounted for based on expected cash flows to be collected increased to $37.1 billion as of December 31,

2012, from $4.7 billion as of December 31, 2011. The increase was largely due to acquired loans from the ING

Direct acquisition.

We regularly update our estimate of the amount of expected principal and interest to be collected from these

loans and evaluate the results on an aggregated pool basis for loans with common risk characteristics. Probable

decreases in expected loan principal cash flows would trigger the recognition of impairment through our

provision for credit losses. Probable and significant increases in expected cash flows would first reverse any

previously recorded allowance for loan and lease losses established subsequent to acquisition, with any

remaining increase in expected cash flows recognized prospectively in interest income over the remaining

estimated life of the underlying loans. We increased the allowance and recorded a provision for credit losses of

$31 million in 2012 related to certain pools of acquired loans. The cumulative impairment recognized on

acquired loans totaled $57 million and $26 million as of December 31, 2012 and 2011, respectively. The credit

performance of the remaining pools has generally been in line with our expectations, and, in some cases, more

favorable than expected, which has resulted in the reclassification of amounts from the nonaccretable difference

to the accretable yield.

Loans Acquired and Accounted for Based on Contractual Cash Flows

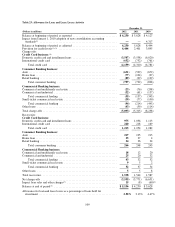

Of the loans acquired in the 2012 U.S. card acquisition, there were loans of $26.2 billion designated as held for

investment that had existing revolving privileges at acquisition and were therefore excluded from the accounting

guidance applied to the acquired loans described in the paragraphs above.

These loans were recorded at a fair value of $26.9 billion, resulting in a net premium of $705 million at

acquisition. Fair value was determined by discounting all expected cash flows (contractual principal, interest,

finance charges and fees of $33.3 billion less those amounts not expected to be collected of $3.0 billion) at a

market discount rate.

Under applicable accounting guidance, we are required to amortize the net premium of $705 million over the

contractual principal amount as an adjustment to interest income over the remaining life of the loans. Given the

guidance applicable to acquired revolving loans, it is necessary to record an allowance through the provision for

99