Capital One 2011 Annual Report Download - page 98

Download and view the complete annual report

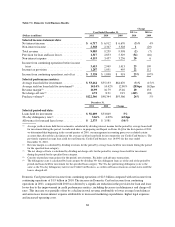

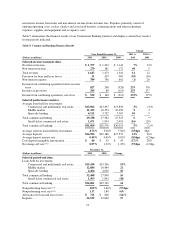

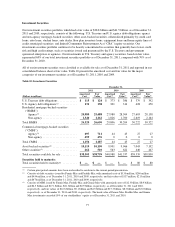

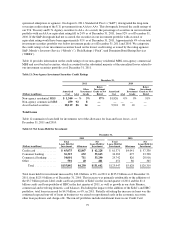

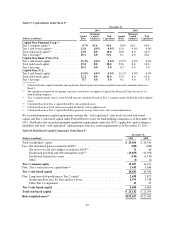

Please find page 98 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(4) Consists of securities collateralized by credit card loans, auto loans, auto dealer floor plan inventory loans and leases,

student loans, equipment loans, and other. The distribution among these asset types was approximately 75% credit card

loans, 11% auto dealer floor plan inventory loans and leases, 6% auto loans, 4% student loans, 2% equipment loans, and

2% other as of December 31, 2011. In comparison, the distribution was approximately 78 % credit card loans, 7%

student loans, 7% auto loans, 6% auto dealer floor plan inventory loans and leases, and 2% equipment loans as of

December 31, 2010. Approximately 86% of the securities in our asset-backed security portfolio were rated AAA or its

equivalent as of December 31, 2011, compared with 90% as of December 31, 2010.

(5) Consists of municipal securities and equity investments, primarily related to CRA activities.

(6) Consists of negative amortization mortgage-backed securities.

We sold approximately $9.2 billion of investment securities, consisting predominantly of agency MBS, in 2011.

We recorded a gain of $259 million on the sale of these securities. We provide additional information in “Market

Risk Profile.”

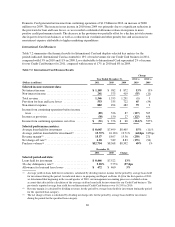

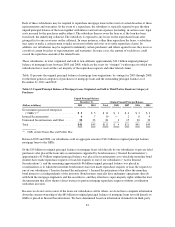

Unrealized gains and losses on our available-for-sale securities are recorded net of tax as a component of

accumulated other comprehensive income (“AOCI”). We had gross unrealized gains of $683 million and gross

unrealized losses of $227 million on available-for sale securities as of December 31, 2011, compared with gross

unrealized gains of $830 million and gross unrealized losses of $281 million on available-for sale securities as of

December 31, 2010. The decrease in gross unrealized losses in 2011 was primarily driven by a tightening of

credit spreads, attributable to the improvement in credit performance and increased liquidity, and lower interest

rates. The substantial majority of the gross unrealized losses as of December 31, 2011 and 2010 related to

non-agency residential MBS. Of the $227 million gross unrealized losses as of December 31, 2011, $169 million

related to securities that had been in a loss position for more than 12 months.

We evaluate available-for-sale securities in an unrealized loss position as of the end of each quarter for other-

than-temporary impairment based on a number of criteria, including the extent and duration of the decline in

value, the severity and duration of the impairment, recent events specific to the issuer and/or industry to which

the issuer belongs, the payment structure of the security, external credit ratings, the failure of the issuer to make

scheduled interest or principal payments, the value of underlying collateral, our intent and ability to hold the

security and current market conditions.

Other-than-temporary impairment (“OTTI”) is recognized in earnings if one of the following conditions exists:

(1) a decision to sell the security has been made; (2) it is more likely than not that we will be required to sell the

security before the impairment is recovered; or (3) the amortized cost basis is not expected to be recovered. If,

however, we have not made a decision to sell the security and we do not expect that we will be required to sell

prior to recovery of the amortized cost basis, only the credit component of other-than-temporary impairment is

recognized in earnings. The noncredit component is recorded in AOCI. The credit component is the difference

between the security’s amortized cost basis and the present value of its expected future cash flows discounted

based on the original yield, while the noncredit component is the remaining difference between the security’s fair

value and amortized cost.

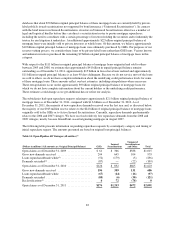

We recognized net OTTI on debt securities of $21 million, $65 million and $32 million in 2011, 2010 and 2009,

respectively, due in part to deterioration in the credit performance of certain securities resulting from the

continued weaknesses in the housing market, high unemployment, and our decision to sell certain other securities

before recovery of the impairment amount.

We provide additional information on our available-for-sale securities in “Note 4—Investment Securities.”

Credit Ratings

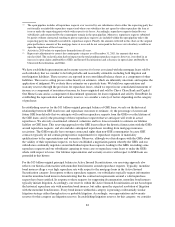

Our investment securities portfolio continues to be heavily concentrated in securities that generally have lower

credit risk and high credit ratings, such as securities issued and guaranteed by the U.S. Treasury and government

78