Capital One 2011 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

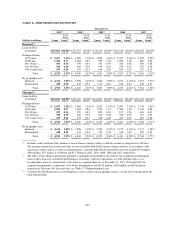

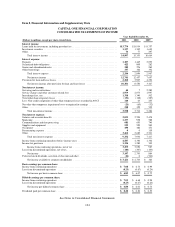

CAPITAL ONE FINANCIAL CORPORATION

CONSOLIDATED BALANCE SHEETS

December 31,

(Dollars in millions, except per share data) 2011 2010

Assets:

Cash and due from banks ................................................... $ 2,097 $ 2,067

Interest-bearing deposits with banks ........................................... 3,399 2,776

Federal funds sold and securities purchased under agreements to resell ............... 342 406

Cash and cash equivalents ............................................... 5,838 5,249

Restricted cash for securitization investors ...................................... 791 1,602

Securities available for sale, at fair value ....................................... 38,759 41,537

Loans held for investment:

Unsecuritized loans held for investment, at amortized cost ..................... 88,242 71,921

Restricted loans for securitization investors ................................. 47,650 54,026

Total loans held for investment ............................................... 135,892 125,947

Less: Allowance for loan and lease losses .................................. (4,250) (5,628)

Net loans held for investment ................................................ 131,642 120,319

Loans held for sale, at lower-of-cost-or-fair value ................................ 201 228

Accounts receivable from securitizations ....................................... 94 118

Premises and equipment, net ................................................. 2,748 2,749

Interest receivable ......................................................... 1,029 1,070

Goodwill ................................................................ 13,592 13,591

Other ................................................................... 11,325 11,040

Total assets .............................................................. $206,019 $197,503

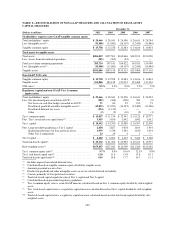

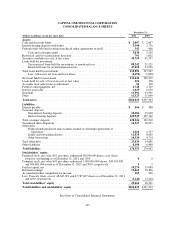

Liabilities:

Interest payable ........................................................... $ 466 $ 488

Customer deposits:

Non-interest bearing deposits ............................................ 18,281 15,048

Interest bearing deposits ................................................ 109,945 107,162

Total customer deposits ..................................................... 128,226 122,210

Securitized debt obligations ................................................. 16,527 26,915

Other debt:

Federal funds purchased and securities loaned or sold under agreements to

repurchase ......................................................... 1,464 1,517

Senior and subordinated notes ............................................ 11,034 8,650

Other borrowings ...................................................... 10,536 4,714

Total other debt ........................................................... 23,034 14,881

Other liabilities ........................................................... 8,100 6,468

Total liabilities ........................................................... 176,353 170,962

Stockholders’ equity:

Preferred stock, par value $.01 per share; authorized 50,000,000 shares; zero shares

issued or outstanding as of December 31, 2011 and 2010 ........................ 00

Common stock, par value $.01 per share; authorized 1,000,000,000 shares; 508,594,308

and 504,801,064 issued as of December 31, 2011 and 2010, respectively ............ 55

Paid-in capital, net ......................................................... 19,274 19,084

Retained earnings ......................................................... 13,462 10,406

Accumulated other comprehensive income ..................................... 169 248

Less: Treasury stock, at cost; 48,647,091 and 47,787,697 shares as of December 31, 2011

and 2010, respectively .................................................... (3,244) (3,202)

Total stockholders’ equity ................................................. 29,666 26,541

Total liabilities and stockholders’ equity ..................................... $206,019 $197,503

See Notes to Consolidated Financial Statements.

135