Capital One 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

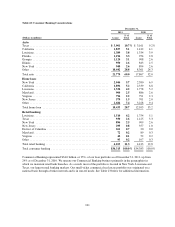

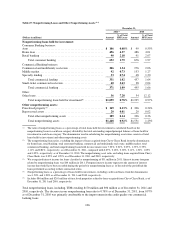

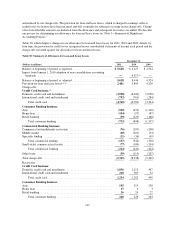

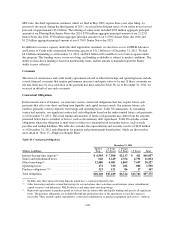

Table 29: Loan Modifications and Restructurings(1)

December 31,

(Dollars in millions) 2011 2010(2)

Modified and restructured loans:

Credit card(3) ................................................................. $ 898 $ 913

Auto(4) ...................................................................... 58 —

Home loan ................................................................... 104 57

Retail banking ................................................................ 80 13

Commercial .................................................................. 426 162

Total ................................................................... $1,566 $1,145

Status of modified and restructured loans:

Performing ................................................................... $1,396 $1,049

Nonperforming ............................................................... 170 96

Total ................................................................... $1,566 $1,145

(1) Reflects modifications and restructuring of loans in our total loan portfolio. The total loan portfolio includes loans

recorded on our balance sheet and loans held in securitization trusts.

(2) Certain prior period amounts have been reclassified to conform to the current period presentation.

(3) Amount reported reflects the total outstanding customer balance, which consists of unpaid principal balance, accrued

interest and fees.

(4) Prior to the first quarter of 2011, modified Auto loans were charged-off at the net collateral value and the remaining asset

balance was reclassified to Other Assets on our consolidated balance sheet.

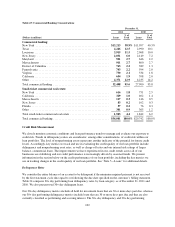

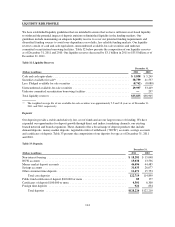

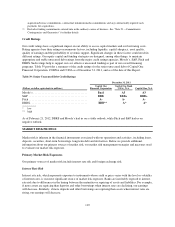

The outstanding balance of loan modifications made to assist borrowers experiencing financial difficulties

increased to $1.6 billion as of December 31, 2011, from $1.1 billion as of December 31, 2010. Of these

modifications, approximately $170 million, or 11%, were classified as nonperforming as of December 31, 2011,

compared with $96 million, or 8%, as of December 31, 2010.

Credit card loan modifications have accounted for the majority of our TDR loan modifications, representing $898

million, or 57%, of the outstanding balance of total TDR loans as of December 31, 2011, and $913 million, or

80%, of the outstanding balance of total TDR loans as of December 31, 2010. The vast majority of our credit

card TDR loan modifications involve a reduction in the interest rate on the account and placing the customer on a

fixed payment plan not exceeding 60 months. In some cases, the interest rate on a credit card account is

automatically increased due to non-payment, late payment or similar events. We determine the effective interest

rate for purposes of measuring impairment on modified loans that involve an increase and are considered to be a

TDR based on the interest rate in effect immediately prior to the loan entering the modification program. In all

cases, we cancel the customer’s available line of credit on the credit card. If the cardholder does not comply with

the modified payment terms, then the credit card loan agreement will revert back to its original payment terms,

with the amount of any loan outstanding reflected in the appropriate delinquency category. The loan amount may

then be charged-off in accordance with our standard charge-off policy.

Home loan modifications represented $104 million, or 7%, of the outstanding balance of total modified loans as

of December 31, 2011, compared with $57 million, or 5%, of the outstanding balance of total modified loans as

of December 31, 2010. The majority of our modified home loans involve a combination of an interest rate

reduction, term extension or principal reduction.

Retail banking loan modifications represented $80 million, or 5% of the outstanding balance of total modified

loans as of December 31, 2011 compared with $13 million or 1% of the outstanding balance of total loans as of

December 31, 2010. Small business loan modifications represent $60 million or 75% of the outstanding Retail

banking loan modifications as of December 31, 2011. Approximately, 50% of the Small Business TDRs in 2011

were added as a result of the adoption of the accounting guidance clarifying TDRs.

109