Capital One 2011 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

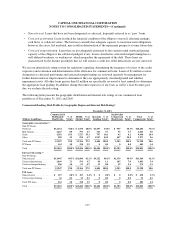

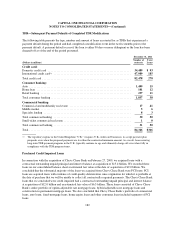

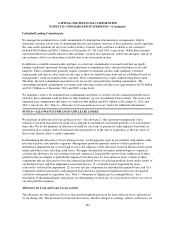

Unfunded Lending Commitments

We manage the potential risk in credit commitments by limiting the total amount of arrangements, both by

individual customer and in total, by monitoring the size and maturity structure of these portfolios and by applying

the same credit standards for all of our credit activities. Unused credit card lines available to our customers

totaled $206.0 billion and $161.5 billion as of December 31, 2011 and 2010, respectively. While these amounts

represented the total available unused credit card lines, we have not experienced, and do not anticipate, that all of

our customers will access their entire available line at any given point in time.

In addition to available unused credit card lines, we enter into commitments to extend credit that are legally

binding conditional agreements having fixed expirations or termination dates and specified interest rates and

purposes. These commitments generally require customers to maintain certain credit standards. Collateral

requirements and loan-to-value ratios are the same as those for funded transactions and are established based on

management’s credit assessment of the customer. These commitments may expire without being drawn upon.

Therefore, the total commitment amount does not necessarily represent future funding requirements. The

outstanding unfunded commitments to extend credit other than credit card lines were approximately $14.8 billion

and $13.2 billion as of December, 2011 and 2010, respectively.

We maintain a reserve for unfunded loan commitments and letters of credit to absorb estimated probable losses

related to these unfunded credit facilities in other liabilities, on our consolidated balance sheets. Our reserve for

unfunded loan commitments and letters of credit was $66 million and $107 million as December 31, 2011 and

2010, respectively. See “Note 6—Allowance for Loan and Lease Losses” below for additional information.

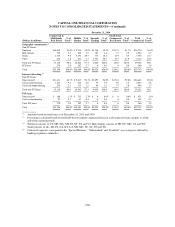

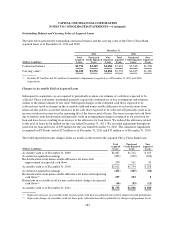

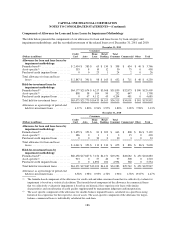

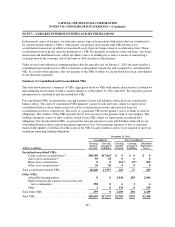

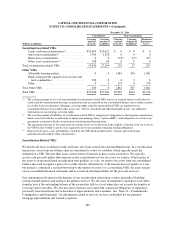

NOTE 6—ALLOWANCE FOR LOAN AND LEASE LOSSES

We maintain an allowance for loan and lease losses (“the allowance”) that represents management’s best

estimate of incurred loan and lease credit losses inherent in our held-for-investment portfolio as of each balance

sheet date. We do not maintain an allowance for held for sale loans or purchased credit-impaired loans that are

performing in accordance with or better than our expectations as of the date of acquisition, as the fair values of

these loans already reflect a credit component.

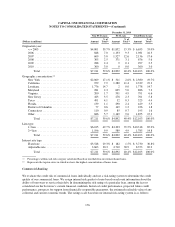

In determining the allowance for loan and lease losses, we disaggregate loans in our portfolio with similar credit

risk characteristics into portfolio segments. Management performs quarterly analysis of these portfolios to

determine if impairment has occurred and to assess the adequacy of the allowance based on historical and current

trends and other factors affecting credit losses. We apply documented systematic methodologies to separately

calculate the allowance for our consumer loan and commercial loan portfolio and for loans within each of these

portfolios that we identify as individually impaired. Our allowance for loan and lease losses consists of three

components that are allocated to cover the estimated probable losses in each loan portfolio based on the results of

our detailed review and loan impairment assessment process: (1) a formula-based component for loans

collectively evaluated for impairment; (2) an asset-specific component for individually impaired loans; and (3) a

component related to purchased credit-impaired loans that have experienced significant decreases in expected

cash flows subsequent to acquisition. See “Note 1—Summary of Significant Accounting Policies” for a

description of the methodologies and policies for determining our allowance for loan and lease losses for each of

our loan portfolio segments.

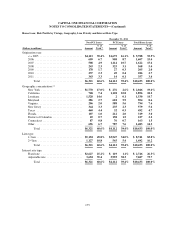

Allowance for Loan and Lease Losses Activity

The allowance for loan and lease losses is increased through the provision for loan and lease losses and reduced

by net charge-offs. The provision for loan and lease losses, which is charged to earnings, reflects credit losses we

184