Capital One 2011 Annual Report Download - page 245

Download and view the complete annual report

Please find page 245 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

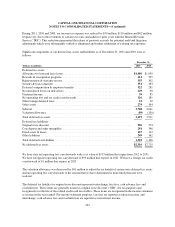

completed its examination of the Company’s federal income tax returns for the years 2007 and 2008 in December

2011. The audit resulted in a net agreed tax liability of $42 million, which the Company paid on January 31,

2012. The Company and the IRS were unable to reach a resolution of one issue for the year 2008, and the

Company filed a protest with the IRS Office of Appeals with respect to this issue that is currently pending. As a

result of the completion of the audit, the amount of the Company’s unrecognized tax benefits increased by $15

million.

On February 10, 2011, the Company finalized a Closing Agreement with the IRS that resolved certain

outstanding issues for the tax years 2000 through 2008 that were unresolved by the April 9, 2010 decision by the

U.S. Tax Court in the Company’s federal tax litigation for the tax years 1995-1999. This agreement did not

impact the Company’s unrecognized tax benefits. On October 21, 2011, the U.S. Court of Appeals for the Fourth

Circuit entered an unfavorable decision on the two issues that the Company had appealed from the Tax Court’s

decision. As a result of the decision, the Company reduced the amount of unrecognized tax benefits with respect

to these issues by approximately $93 million.

It is reasonably possible that further settlements related to the Company’s unrecognized tax benefits may be

made within twelve months of the reporting date. At this time, an estimate of the potential change to the amount

of unrecognized tax benefits resulting from such settlements cannot be made.

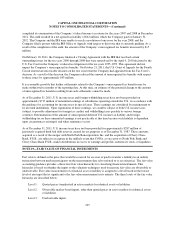

As of December 31, 2011, U.S. income taxes and foreign withholding taxes have not been provided on

approximately $717 million of unremitted earnings of subsidiaries operating outside the U.S., in accordance with

the guidance for accounting for income taxes in special areas. These earnings are considered by management to

be invested indefinitely. Upon repatriation of these earnings, we could be subject to both U.S. income taxes

(subject to possible adjustment for foreign tax credits) and withholding taxes payable to various foreign

countries. Determination of the amount of unrecognized deferred U.S. income tax liability and foreign

withholding tax on these unremitted earnings is not practicable at this time because such liability is dependent

upon circumstances existing if and when remittance occurs.

As of December 31, 2011, U.S. income taxes have not been provided for approximately $287 million of

previously acquired thrift bad debt reserves created for tax purposes as of December 31, 1987. These amounts,

acquired as a result of the merger with North Fork Bancorporation, Inc. and the acquisition of Chevy Chase

Bank, F.S.B., are subject to recapture in the unlikely event that CONA, as successor to North Fork Bank and

Chevy Chase Bank F.S.B., makes distributions in excess of earnings and profits, redeems its stock, or liquidates.

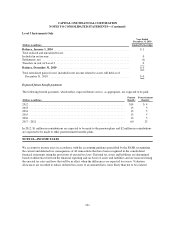

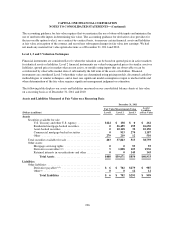

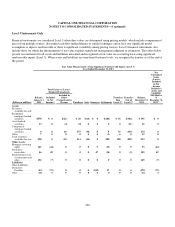

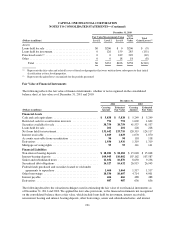

NOTE 19—FAIR VALUE OF FINANCIAL INSTRUMENTS

Fair value is defined as the price that would be received for an asset or paid to transfer a liability in an orderly

transaction between market participants on the measurement date (also referred to as an exit price). The fair value

accounting guidance provides a three-level fair value hierarchy for classifying financial instruments. This

hierarchy is based on whether the inputs to the valuation techniques used to measure fair value are observable or

unobservable. Fair value measurement of a financial asset or liability is assigned to a level based on the lowest

level of any input that is significant to the fair value measurement in its entirety. The three levels of the fair value

hierarchy are described below:

Level 1: Quoted prices (unadjusted) in active markets for identical assets or liabilities.

Level 2: Observable market-based inputs, other than quoted prices in active markets for identical assets

or liabilities.

Level 3: Unobservable inputs.

225