Capital One 2011 Annual Report Download - page 256

Download and view the complete annual report

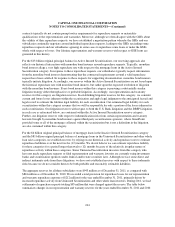

Please find page 256 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

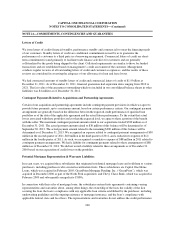

business segments. Accordingly, net gains and losses on our investment securities portfolio and certain

trading activities are included in the Other category. The Other category also includes foreign exchange-rate

fluctuations related to the revaluation of foreign currency-denominated investments; certain gains (losses)

on the sale and securitization of loans; unallocated corporate expenses that do not directly support the

operations of the business segments or for which the business segments are not considered financially

accountable in evaluating their performance, such as acquisition and restructuring charges; provisions for

representation and warranty reserves related to continuing operations; certain material items that are

non-recurring in nature; and offsets related to certain line-item reclassifications.

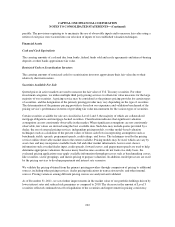

Basis of Presentation

We report the financial results of our business segments on a continuing operations basis. See “Note 3—

Discontinued Operations” for a discussion of discontinued operations. The results of our individual businesses,

which are prepared on an internal management accounting and reporting basis, reflect the manner in which

management evaluates performance and makes decisions about funding our operations and allocating

resources. We refer to the business segment results derived from our internal management accounting and

reporting process as our “managed” presentation, which differs in some cases from our reported results prepared

based on U.S. GAAP. There is no comprehensive, authoritative body of guidance for management accounting

equivalent to U.S. GAAP; therefore, the managed basis presentation of our business segment results may not be

comparable to similar information provided by other financial service companies. In addition, our individual

business segment results should not be used as a substitute for comparable results determined in accordance with

U.S. GAAP.

Prior to January 1, 2010, our managed-basis presentation assumed that our securitized loans had not been sold

and that the earnings from securitized loans were classified in our results of operations in the same manner as the

earnings on loans that we owned. Our managed results also reflected differences in accounting for the valuation

of retained interests and the recognition of gains and losses on the sale of interest-only strips. Our managed

results did not include the addition of an allowance for loan and lease losses for the loans underlying our

off-balance sheet securitization trusts. The adoption on January 1, 2010 of the new consolidation accounting

standards resulted in accounting for the loans in our securitization trusts in our reported financial statements in a

manner similar to how we account for these loans on a managed basis. As a result, our total reported and

managed basis presentations are generally comparable for periods beginning after January 1, 2010.

We may periodically change our business segments or reclassify business segment results based on modifications

to our management reporting methodologies and changes in organizational alignment.

Business Segment Reporting Methodology

The results of our business segments are intended to reflect each segment as if it were a stand-alone business. We

have developed allocation methods for use in our internal management accounting and reporting process to

assign certain managed balance sheet assets, deposits and other liabilities and their related revenue and expenses

directly or indirectly attributable to each business segment. These allocation methods include funds transfer

pricing and various other internally-developed methodologies and assumptions management believes are

appropriate to reflect the results of each business segment. Due to the integrated nature of our business segments,

estimates and judgments have been made in allocating certain revenue and expense items. Transactions between

segments are based on specific criteria or approximate third-party rates. We regularly assess the assumptions,

methodologies and reporting classifications used for segment reporting, which may result in the implementation

of refinements or changes in future periods.

236