Capital One 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

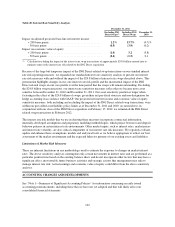

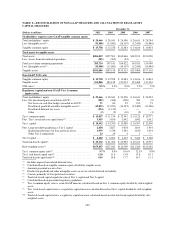

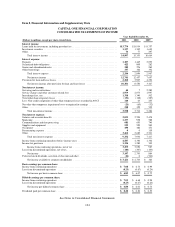

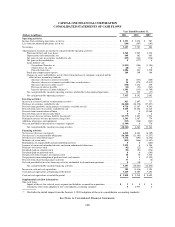

TABLE E—SUMMARY OF ALLOWANCE FOR LOAN AND LEASE LOSSES

December 31,

(Dollars in millions) 2011 2010 2009 2008 2007

Balance as of beginning of period, as reported ............. $ 5,628 $ 4,127 $ 4,524 $ 2,963 $ 2,180

Impact from January 1, 2010 adoption of new consolidation

accounting standards ............................... —4,317(1) ———

Balance at beginning of period, as adjusted ............... 5,628 8,444 4,524 2,963 2,180

Provision for loan and lease losses(2)(3) .................. 2,401 3,895 4,230 5,101 2,717

Charge-offs:

Domestic credit card and installment(3) ............... (3,558) (6,020) (3,050) (2,244) (1,315)

International credit card and installment .............. (752) (761) (284) (255) (253)

Consumer banking ............................... (732) (898) (1,357) (1,396) (965)

Commercial banking ............................. (214) (444) (444) (87) (17)

Other loans ..................................... (59) (115) (207) (169) (31)

Total charge-offs .................................... (5,315) (8,238) (5,342) (4,151) (2,581)

Recoveries:

Domestic credit card and installment ................ 1,036 1,113 447 425 393

International credit card and installment .............. 218 169 52 65 72

Consumer banking ............................... 248 243 263 178 151

Commercial banking ............................. 37 54 10 4 4

Other loans ..................................... 5821—

Total recoveries ..................................... 1,544 1,587 774 673 620

Net charge-offs (3,771) (6,651) (4,568) (3,478) (1,961)

Impact from acquisitions, sales and other changes(4) ........ (8) (60) (59) (62) 27

Balance as of end of period ............................ $ 4,250 $ 5,628 $ 4,127 $ 4,524 $ 2,963

Allowance for loan and lease losses as a percentage of loans

held for investment ................................ 3.13% 4.47% 4.55% 4.48% 2.91%

Allowance for loan and lease losses by geographic

distribution:

Domestic ...................................... $ 3,778 $ 5,168 $ 3,928 $ 4,331 $ 2,754

International .................................... 472 460 199 193 209

Total .............................................. $ 4,250 $ 5,628 $ 4,127 $ 4,524 $ 2,963

Allowance for loan and lease losses by loan category:

Domestic card .................................. $ 2,375 $ 3,581 $ 1,927 $ 2,544 $ 1,429

International card ................................ 472 460 199 193 209

Consumer banking ............................... 652 675 1,076 1,314 1,005

Commercial banking ............................. 711 826 785 301 153

Other ......................................... 40 86 140 172 167

Total .............................................. $ 4,250 $ 5,628 $ 4,127 $ 4,524 $ 2,963

(1) Includes an adjustment of $53 million made in the second quarter of 2010 for the impact as of January 1, 2010 of

impairment on consolidated loans accounted for as TDRs.

(2) Excludes a negative provision for unfunded lending commitments of $41 million and a provision for unfunded lending

commitments of $12 million for 2011 and 2010, respectively.

(3) The reduction in the provision for loan and lease losses attributable to Kohl’s was $257 million for 2011. Loss sharing

amounts attributable to Kohl’s reduced charge-offs by $118 million in 2011. The expected reimbursement from Kohl’s

netted in our allowance for loan and lease losses was approximately $139 million as of December 31, 2011.

(4) Includes a reduction in our allowance for loan and lease losses of $73 million during the first quarter of 2010 attributable

to the sale of certain interest-only option-ARM bonds and the deconsolidation of the related securitization trusts related

to Chevy Chase Bank in the first quarter of 2010.

128