Capital One 2011 Annual Report Download - page 293

Download and view the complete annual report

Please find page 293 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298

|

|

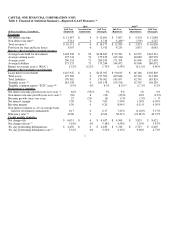

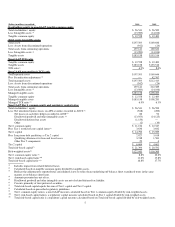

CAPITAL ONE FINANCIAL CORPORATION (COF)

Table 2: Explanatory Notes (Table 1)

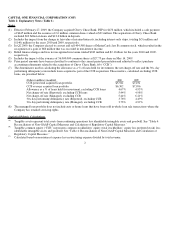

Notes

Statistical/Metric Calculations

2

(1) Effective February 27, 2009, the Company acquired Chevy Chase Bank, FSP for $476 million, which included a cash payment

of $445 million and the issuance of 2.6 million common shares valued at $31 million. The acquisition of Chevy Chase Bank

included $10 billion in loans and $13.6 billion in deposits.

(2) Includes the impact from the change in fair value of retained interests, including interest-only strips, totaling $(5) million and

$(146) million for the years 2010 and 2009, respectively.

(3) In Q2 2009, the Company elected to convert and sell 404,508 shares of MasterCard class B common stock, which resulted in the

recognition of a gain of $66 million that was recorded in non-interest income.

(4) Billed finance charges and fees not recognized in revenue totaled $949 million and $2.1 billion for the years 2010 and 2009,

respectively.

(5) Includes the impact of the issuance of 56,000,000 common shares at $27.75 per share on May 14, 2009.

(6) Prior period amounts have been reclassified to conform to the current period presentation and adjusted to reflect purchase

accounting refinements related to the acquisition of Chevy Chase Bank, fsb (“CCB”).

(7) The denominator used in calculating the allowance as a % of loans held for investment, the net charge-off rate and the 30+ day

performing delinquency rate include loans acquired as part of the CCB acquisition. These metrics, calculated excluding CCB

loans, are presented below.

(Dollars in millions) (unaudited) 2010 2009

CCB period end acquired loan portfolio

$5,532

$7,251

CCB average acquired loan portfolio

$6,302

$7,996

Allowance as a % of loans held for investment, excludin

g

CCB loans

4.67%

4.95%

Net charge-off rate (Reported), excluding CCB loans

5.44%

4.98%

Net charge-off rate (Managed), excluding CCB

5.44%

6.21%

30+ day performing delinquency rate (Reported), excluding CCB

3.76%

4.49%

30+ day performing delinquency rate (Managed), excluding CCB

3.76%

4.99%

(8) The managed loan portfolio does not include auto or home loans that have been sold in whole loan sale transactions where the

Company has retained servicing rights.

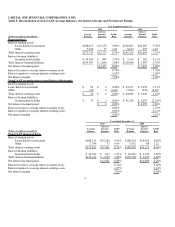

Tangible assets represent total assets from continuing operations less identifiable intangible assets and goodwill. See “Table 4:

Reconciliation of Non-GAAP Capital Measures and Calculation of Regulatory Capital Measures.”

Tangible common equity (“TC

E

”) represents common stockholders’ equity (total stockholders’ equity less preferred stock) less

identifiable intangible assets and goodwill. See “Table 4: Reconciliation of Non-GAAP Capital Measures and Calculation of

Regulatory Capital Measures.”

Calculated based on non-interest expense less restructuring expense divided by total revenue.

(A)

(B)

(C)