Capital One 2011 Annual Report Download - page 279

Download and view the complete annual report

Please find page 279 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298

|

|

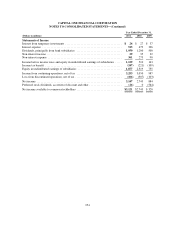

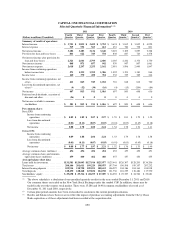

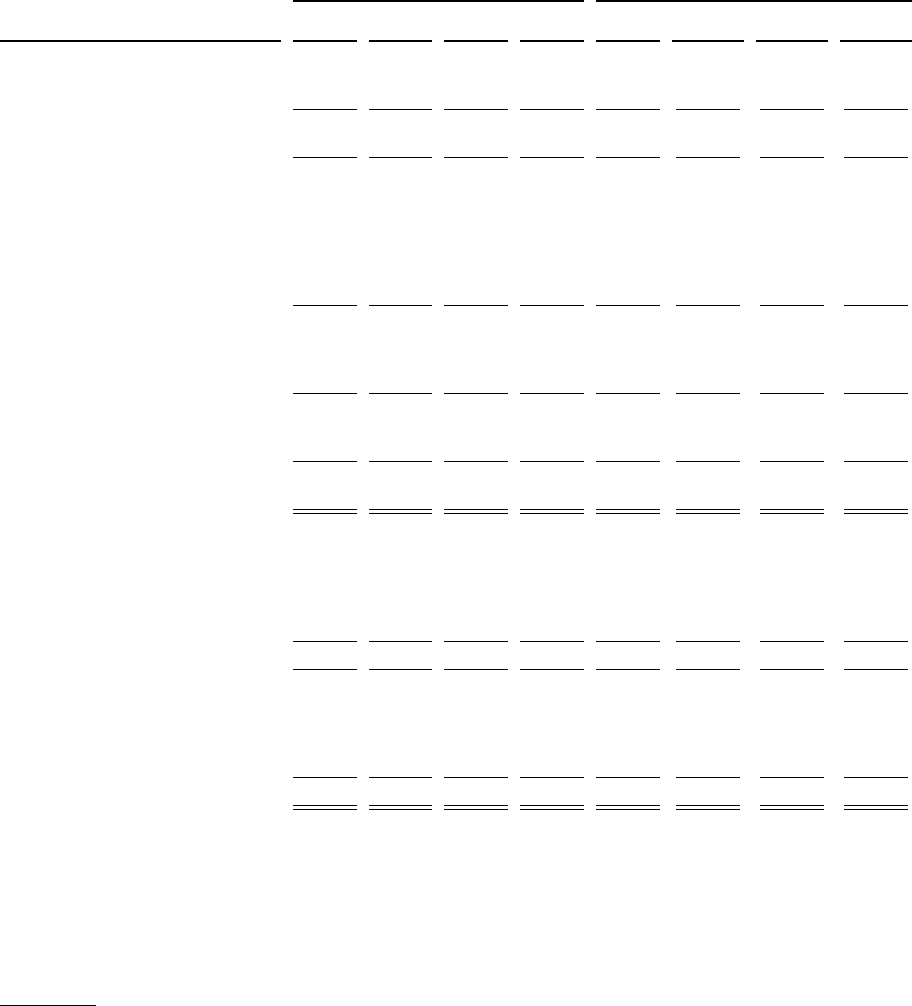

CAPITAL ONE FINANCIAL CORPORATION

Selected Quarterly Financial Information(1) (2)

2011 2010

(Dollars in millions)(Unaudited)

Fourth

Quarter

Third

Quarter

Second

Quarter

First

Quarter

Fourth

Quarter

Third

Quarter(3)

Second

Quarter(3)

First

Quarter(3)

Summary of results of operations:

Interest income .................... $ 3,701 $ 3,835 $ 3,699 $ 3,752 $ 3,674 $ 3,815 $ 3,835 $ 4,029

Interest expense .................... 519 552 563 612 651 706 738 801

Net interest income ................. 3,182 3,283 3,136 3,140 3,023 3,109 3,097 3,228

Provision for loan and lease losses ..... 861 622 343 534 838 867 723 1,478

Net interest income after provision for

loan and lease losses .............. 2,321 2,661 2,793 2,606 2,185 2,242 2,374 1,750

Non-interest income ................ 868 871 857 942 939 907 807 1,061

Non-interest expense ................ 2,618 2,297 2,255 2,162 2,091 1,996 2,000 1,847

Income from continuing operations

before income taxes .............. 571 1,235 1,395 1,386 1,032 1,153 1,181 964

Income taxes ...................... 160 370 450 354 332 335 369 244

Income from continuing operations, net

oftax .......................... 411 865 945 1,032 701 818 812 720

Loss from discontinued operations, net

of tax(2) ........................ (4) (52) (34) (16) (4) (15) (204) (84)

Net income ....................... 407 813 911 1,016 697 803 608 636

Preferred stock dividends, accretion of

discount and other ................ (26) 0 0 0 0000

Net income available to common

stockholders .................... $ 381 $ 813 $ 911 $ 1,016 $ 697 $ 803 $ 608 $ 636

Per common share:

Basic EPS:

Income from continuing

operations .................. $ 0.89 $ 1.89 $ 2.07 $ 2.27 $ 1.55 $ 1.81 $ 1.79 $ 1.59

Loss from discontinued

operations .................. (0.01) (0.11) (0.07) (0.03) (0.01) (0.03) (0.45) (0.18)

Net income ................... 0.88 1.78 2.00 2.24 1.54 1.78 1.34 1.41

Diluted EPS:

Income from continuing

operations .................. 0.89 1.88 2.04 2.24 1.53 1.79 1.78 1.58

Loss from discontinued

operations .................. (0.01) (0.11) (0.07) (0.03) (0.01) (0.03) (0.45) (0.18)

Net income ................... $ 0.88 $ 1.77 $ 1.97 $ 2.21 $ 1.52 $ 1.76 $ 1.33 $ 1.40

Average common shares (millions) .... 456 456 456 454 453 453 452 451

Average common shares and common

equivalent shares (millions) ........ 459 460 462 460 457 457 456 455

Average balance sheet data:

Loans held for investment ............ $131,581 $129,043 $127,916 $125,077 $125,441 $126,307 $128,203 $134,206

Total assets ....................... 200,106 201,611 199,229 198,075 197,704 196,598 199,357 207,232

Interest-bearing deposits ............. 109,914 110,750 109,251 108,633 106,597 104,186 104,163 104,018

Total deposits ..................... 128,450 128,268 125,834 124,158 121,736 118,255 118,484 117,530

Stockholders’ equity ................ $ 29,698 $ 29,316 $ 28,255 $ 27,009 $ 26,255 $ 25,307 $ 24,526 $ 23,681

(1) The above schedule is a tabulation of our unaudited quarterly results for the years ended December 31, 2011 and 2010.

Our common shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be

traded in the over-the-counter stock market. There were 15,286 and 14,981 common stockholders of record as of

December 31, 2011 and 2010, respectively.

(2) Certain prior period amounts have been reclassified to conform to the current period presentation.

(3) Results and balances have been recast to reflect the impact of purchase accounting adjustments from the Chevy Chase

Bank acquisition as if those adjustments had been recorded at the acquisition date.

259