Capital One 2011 Annual Report Download - page 70

Download and view the complete annual report

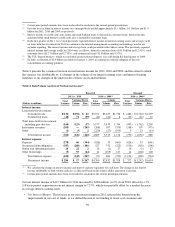

Please find page 70 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.During 2010, we made significant refinements to our process for estimating our representation and warranty

reserve, due primarily to increased counterparty activity and our ability to extend the timeframe, in most

instances, over which we estimate the repurchase liability for mortgage loans sold by our subsidiaries to GSEs

and those mortgage loans placed into Active Insured Securitizations to the full life of the mortgage loans. Prior to

the second quarter of 2010, we generally estimated the amount of probable repurchase requests to be received

over the next 12 months. As a result of these refinements, we recorded a substantial increase in our representation

and warranty repurchase reserve in the first and second quarters of 2010. Approximately $407 million of the

provision for representation and warranty reserves of $636 million recorded in 2010 resulted from the extension

of our repurchase liability estimates to the full life of the loan effective in the second quarter of 2010. The

remaining $229 million related primarily to changing counterparty activity in the form of updated estimates

around active and probable litigation, most of which occurred in the first quarter of 2010.

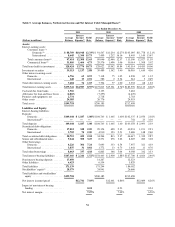

Our aggregate representation and warranty mortgage repurchase reserves, which we report as a component of

other liabilities in our consolidated balance sheets, totaled $943 million as of December 31, 2011, compared with

$816 million as of December 31, 2010. The adequacy of the reserves and the ultimate amount of losses incurred

by us or one of our subsidiaries will depend on, among other things, actual future mortgage loan performance, the

actual level of future repurchase and indemnification requests, the actual success rates of claimants,

developments in litigation, actual recoveries on the collateral and macroeconomic conditions (including

unemployment levels and housing prices). See “Consolidated Balance Sheet Analysis—Potential Mortgage

Representation & Warranty Liabilities” below and “Note 21—Commitments, Contingencies and Guarantees” for

additional information.

Asset Impairment

We review other assets for impairment on a regular basis. This process requires significant management

judgment and involves various estimates and assumptions. Our investment securities and goodwill and intangible

assets represent a significant portion of our other assets. Accordingly, below we describe our process for

assessing impairment of these assets and the key estimates and assumptions involved in this process.

Investment Securities

We regularly review investment securities for other-than-temporary impairment using both quantitative and

qualitative criteria. If we intend to sell a security in an unrealized loss position or it is more likely than not we

will be required to sell a security before its anticipated recovery, the entire difference between the amortized cost

basis of the security and its fair value is recognized in earnings. If we do not intend to sell the security and it is

not more likely than not that we will be required to sell the security before recovery of our amortized cost, we

evaluate other qualitative criteria to determine whether a credit loss exists. Our evaluation requires significant

management judgment and a consideration of many factors, including, but not limited to, the extent and duration

of the impairment; the health of and specific prospects for the issuer, including whether the issuer has failed to

make scheduled interest or principal payments; recent events specific to the issuer and/or industry to which the

issuer belongs; the payment structure of the security; external credit ratings; the value of underlying collateral

and current market conditions. Quantitative criteria include assessing whether there has been an adverse change

in expected future cash flows. For equity securities, our evaluation criteria include the length of time and

magnitude of the amount that each security is in an unrealized loss position. See “Note 4—Investment

Securities” for additional information.

Goodwill and Other Intangible Assets

As a result of our acquisitions, principally Hibernia Corporation in 2005, North Fork Bancorporation in 2006,

and Chevy Chase Bank in 2009, we have goodwill and other intangible assets. Goodwill resulting from business

combinations prior to January 1, 2009 represents the excess of the purchase price over the fair value of the net

assets of businesses acquired. Goodwill resulting from business combinations after January 1, 2009, is generally

50