Capital One 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or programs cannot be measured quantitatively. Where deficiencies are discovered, we seek to update the risk

management program to resolve the deficiencies in a timely manner. Significant deficiencies are escalated to the

appropriate risk executive or risk committee. Clear accountability is defined when resolving deficiencies so that

the desired outcome is achieved. Risk management programs are monitored at every level from the overall

Enterprise Risk Management Program to the individual risk management activities in each business area.

Organization and Culture

Our intent is to create and maintain an effective risk management organization and culture. A strong organization

and culture promotes risk management as a key factor in making important business decisions and helps drive

risk management activities deeper into the company. An effective risk management culture starts with a well-

defined risk management philosophy. It requires established risk management objectives that align to business

objectives and make targeted risk management activities part of ongoing business management activities. We

believe we staff risk functions at the appropriate levels with qualified associates and effective tools that support

risk management practices and activities. Senior management and the Board of Directors are ultimately

accountable for promoting adherence to sound risk principles and tolerances. We seek to incent associates at all

levels to perform according to corporate policies and risk tolerance and in conformity with applicable laws and

regulations. Additionally, management establishes performance goals, plans, and incentives that are designed to

promote financial performance within the confines of a sound risk management program and within defined risk

tolerances.

We have a corporate Code of Business Conduct and Ethics (the “Code”) (available on the Corporate Governance

page of our website at www.capitalone.com/about) under which each associate is obligated to behave with

integrity in dealing with customers and business partners and to comply with applicable laws and regulations. We

disclose any waivers to the Code on our website. We also have an associate performance management process

that emphasizes achieving business results while ensuring integrity, compliance, and sound business

management.

Risk Appetite

We have a defined risk appetite for each of our eight risk categories that is approved by the Board of Directors.

Stated risk appetites define the parameters for taking and accepting risks and are used by management and the

Board of Directors to make business decisions.

For some risk categories (credit, liquidity, market), our risk appetite statements are translated into largely

quantitative limits and guidelines. For other risk categories, our risk appetite is defined more qualitatively and is

supported by indicative metrics where appropriate. We communicate risk appetite statements, metrics and limits

to the appropriate levels in the organization and monitor adherence.

Primary Risk Categories

Below we provide an overview of how we manage our eight primary risk categories. Following this section, we

provide detailed information and metrics about three of our most significant risk exposures: credit, liquidity and

market.

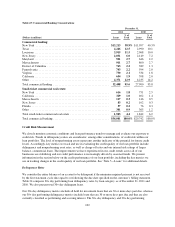

Credit Risk Management

The Chief Risk Officer, in conjunction with the Consumer and Commercial Chief Credit Officers, is responsible

for establishing credit risk policies and procedures, including underwriting and hold guidelines and credit

approval authority, and monitoring credit exposure and performance of our lending-related transactions. These

responsibilities are fulfilled by the Chief Consumer Credit Officer and the Chief Commercial Credit Officer.

Division Presidents are responsible for managing the credit risk within their division and maintaining processes

93