Capital One 2011 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

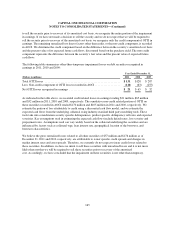

If the agreement involves payments between participants under a revenue or loss sharing arrangement, we must

determine whether to report revenue or loss amounts on a gross basis or on a net basis after taking into

consideration payments due to or due from participants. We evaluate the contractual provisions of each

transaction and applicable accounting guidance in determining the manner in which to report the impact of

revenue and loss sharing amounts in our consolidated balance sheet and the related impact on our allowance for

loan and lease losses. Our consolidated net income is the same regardless of whether we record revenue or

expense amounts on a gross or net basis.

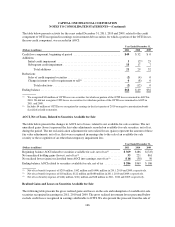

2011 Acquisitions

Hudson’s Bay Company Credit Card Portfolio

On January 7, 2011, in a cash transaction, we acquired the credit card portfolio of Hudson’s Bay Company

(“HBC”), a Canadian operation, from GE Capital Retail Finance. The acquisition and partnership with HBC

significantly expands our credit card customer base in Canada, tripling the number of customer accounts, and

provides an additional distribution channel. The acquisition included outstanding credit card loan receivables

with a fair value of approximately $1.4 billion, and a transfer of approximately 400 employees directly involved

in managing the HBC portfolio.

We accounted for the acquisition as a business combination. Accordingly, we recorded the assets acquired,

including identifiable intangible assets, and liabilities assumed at their respective fair values as of the acquisition

date and consolidated with our results. In connection with the acquisition, we recorded goodwill of $3 million

representing the amount by which the purchase price exceeded the fair value of the net assets acquired. We also

recognized a purchased credit card relationship intangible asset of $11 million at acquisition and a contract-based

intangible asset of $70 million. Because the acquisition was considered to be a taxable transaction, the goodwill

is deductible for tax purposes. The goodwill was assigned to the International Credit Card reporting unit of our

Credit Card segment, and the acquired loan portfolio is reflected in the operations of our International Credit

Card business.

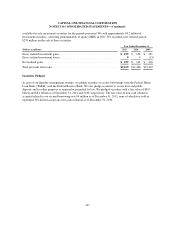

Kohl’s Credit Card Portfolio

In August 2010, we entered into a private-label credit card partnership agreement with Kohl’s Department Stores

(“Kohl’s”). In connection with the partnership agreement, effective April 1, 2011, we acquired Kohl’s existing

private-label credit card loan portfolio from JPMorgan Chase & Co. The existing portfolio, which consists of

more than 20 million Kohl’s customer accounts, had an outstanding principal and interest balance of

approximately $3.7 billion at acquisition. The partnership agreement has an initial seven-year term and an

automatic one-year renewal thereafter. We accounted for the purchase as an asset acquisition.

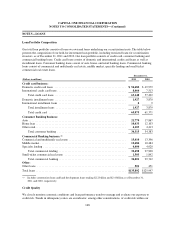

Under the terms of the partnership agreement and in conjunction with the acquisition, we began issuing Kohl’s

branded private-label credit cards to new and existing Kohl’s customers on April 1, 2011. Risk management

decisions are jointly managed by Kohl’s and us, but we retain final authority over risk management decisions.

Kohl’s has primary responsibility for handling customer service functions and advertising and marketing related

to credit card customers.

We share a fixed percentage of revenues, consisting of finance charges and late fees, with Kohl’s, and Kohl’s is

required to reimburse us for a fixed percentage of credit losses incurred. Revenues and losses related to the

Kohl’s credit card program are reported on a net basis in our consolidated financial statements. The revenue

sharing amounts earned by Kohl’s are reflected as an offset against our revenues in our consolidated statements

of income. The loss sharing amounts from Kohl’s are reflected as a reduction in our provision for loan and lease

158