Capital One 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

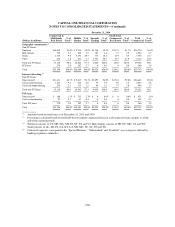

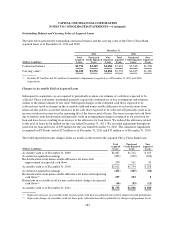

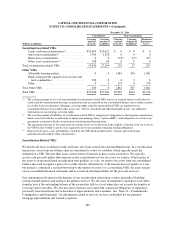

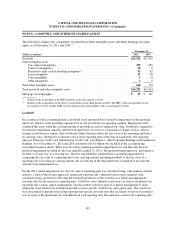

December 31, 2010

Consolidated Non-Consolidated

(Dollars in millions)

Carrying

Amount

of Assets

Carrying

Amount of

Liabilities

Carrying

Amount

of Assets(1)

Carrying

Amount of

Liabilities(2)

Maximum

Exposure to

Loss(3)

Securitization-related VIEs:

Credit card loan securitizations(4) ............ $53,694 $25,622 $ 0 $ 0 $ 0

Auto loan securitizations(4) ................. 1,784 1,518 0 0 0

Home loan securitizations .................. 0 0 174

(1) 37(2) 297

Other asset securitizations(4) ................ 198 64 0 0 0

Total securitization related VIEs ................ 55,676 27,204 174 37 297

Other VIEs:

Affordable housing entities ................. 0 0 1,681 304 1,681

Entities that provide capital to low-income and

rural communities ...................... 230 0 6 3 6

Other .................................. 0 0 174 0 174

Total Other VIEs ............................. 230 0 1,861 307 1,861

Total VIEs .................................. $55,906 $27,204 $2,035 $344 $2,158

(1) The carrying amount of assets of unconsolidated securitization-related VIEs consists of retained interests and letters of

credit related to manufactured housing securitizations and are reported on our consolidated balance sheets under accounts

receivable from securitizations. Mortgage servicing rights related to unconsolidated VIEs are reported on our

consolidated balance sheets under other assets. See “Note 8—Goodwill and Other Intangible Assets” for additional

information on our mortgage servicing rights.

(2) The carrying amount of liabilities of securitization related VIEs is comprised of obligations to fund negative amortization

bonds associated with the securitization of option arm mortgage loans (“option-ARMs”) and obligations on certain swap

agreements associated with the securitization of manufactured housing loans.

(3) The maximum exposure to loss represents the amount of loss we would incur in the unlikely event that all of our assets in

the VIE become worthless and we were required to meet our maximum remaining funding obligations.

(4) Represents the gross assets and liabilities owned by the VIE which included seller’s interest and retained and

repurchased notes held by other related parties.

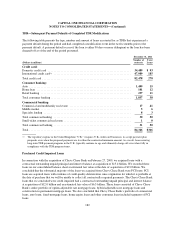

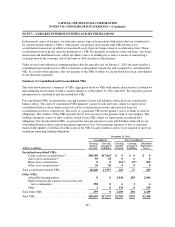

Securitization Related VIEs

We historically have securitized credit card loans, auto loans, home loans and installment loans. In a securitization

transaction, assets from our balance sheet are transferred to a trust we establish, which typically meets the

definition of a VIE. The trust then issues various forms of interests in those assets to investors. We typically

receive cash proceeds and/or other interests in the securitization trust for the assets we transfer. If the transfer of

the assets to an unconsolidated securitization trust qualifies as a sale, we remove the assets from our consolidated

balance sheet and recognize a gain or loss on the transfer. Alternatively, if the transfer does not qualify as a sale

but instead is considered a secured borrowing or the transfer of assets is to a consolidated VIE, the assets remain

on our consolidated financial statements and we record an offsetting liability for the proceeds received.

Our continuing involvement in the majority of our securitization transactions consists primarily of holding

certain retained interests and acting as the primary servicer. We also may be required to repurchase receivables

from the trust if the outstanding balance of the receivables falls to a level where the cost exceeds the benefits of

servicing such receivables. We also may have exposure associated with contractual obligations to repurchase

previously transferred loans due to breaches of representations and warranties. See “Note 21—Commitments,

Contingencies and Guarantees” for information related to reserves we have established for our potential

mortgage representation and warranty exposure.

188