Capital One 2011 Annual Report Download - page 130

Download and view the complete annual report

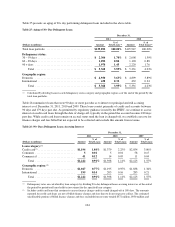

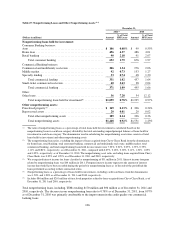

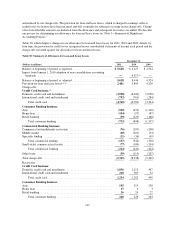

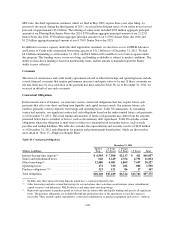

Please find page 130 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Commercial loan modifications represented $426 million, or 27%, of the outstanding balance of total modified

loans as of December 31, 2011, compared with $162 million, or 14%, of the outstanding balance of total

modified loans as of December 31, 2010. As a result of the adoption of the accounting guidance clarifying TDRs,

$120 million or 40% of Commercial TDRs were added in 2011. The vast majority of modified commercial loans

include a reduction in interest rate or a term extension.

We provide additional information on modified loans accounted for as TDRs, including the performance of those

loans subsequent to modification, in “Note 5—Loans.”

Impaired Loans

A loan is considered impaired when, based on current information and events, it is probable that we will be

unable to collect all amounts due from the borrower in accordance with the original contractual terms of the loan.

Loans defined as individually impaired, based on applicable accounting guidance, include larger balance

commercial nonperforming loans and TDR loans. We do not report nonperforming consumer loans that have not

been modified in a TDR as individually impaired, as we collectively evaluate these smaller-balance homogenous

loans for impairment in accordance with applicable accounting guidance. Loans held for sale are also not

reported as impaired, as these loans are recorded at lower of cost or fair value. Impaired loans also exclude loans

acquired from Chevy Chase Bank because these loans were recorded at fair value upon acquisition.

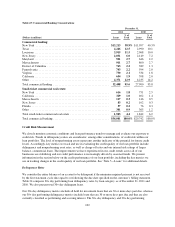

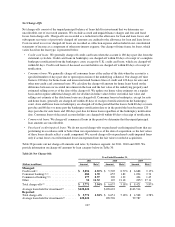

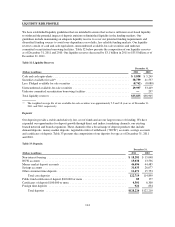

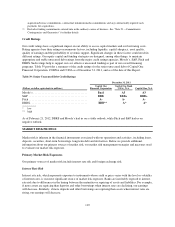

Impaired loans, including TDRs, totaled $1.8 billion as of December 31, 2011, compared with $1.5 billion as of

December 31, 2010. TDRs accounted for $1.6 billion and $1.1 billion of impaired loans as of December 31, 2011

and 2010, respectively. We provide additional information on our impaired loans, including the allowance

established for these loans, in “Note 5—Loans” and “Note 6—Allowance for Loan and Lease Losses.”

Purchased Credit-Impaired Loans

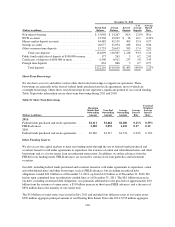

Purchased credit-impaired loans decreased to $4.7 billion as of December 31, 2011, from $5.6 billion as of

December 31, 2010. Our portfolio of purchased credit-impaired loans consists of loans acquired in the Chevy

Chase Bank transaction, which were recorded at fair value at the date of acquisition. The fair value of these loans

included an estimate of credit losses expected to be realized over the remaining lives of the loans. Therefore, no

allowance for loan and lease losses was recorded for these loans as of the acquisition date. However, we

regularly update the amount of expected principal and interest to be collected from these loans and evaluate the

results on an aggregated pool basis for loans with common risk characteristics. Probable decreases in expected

loan principal cash flows would trigger the recognition of impairment through our provision for loan and lease

losses. Probable and significant increases in expected cash flows would first reverse any previously recorded

allowance for loan and losses, with any remaining increase in expected cash flows recognized prospectively in

interest income over the remaining estimated life of the underlying loans. We reduced the allowance related to

this pool of loans by $6 million for the year ended December 31, 2011. We recorded impairment through our

provision for loan and losses of $33 million for the year ended December 31, 2010. The cumulative impairment

recognized on PCI loans totaled $27 million as of December 31, 2011 and $33 million as of December 31, 2010.

The credit performance of the remaining pools has generally been in line with our expectations, and, in some

cases, more favorable than expected, which has resulted in the reclassification of amounts from the nonaccretable

difference to the accretable yield. We provide additional information on the PCI loans acquired from Chevy

Chase Bank in “Note 5—Loans.”

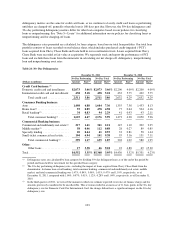

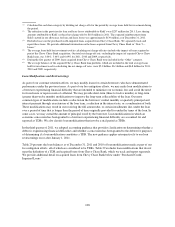

Allowance for Loan and Lease Losses

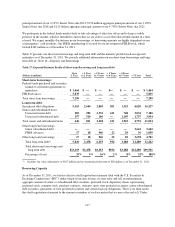

Our allowance for loan and lease losses represents management’s best estimate of incurred loan and lease credit

losses inherent in our held-for-investment portfolio as of each balance sheet date. We do not maintain an

allowance for held-for-sale loans or purchased-credit impaired loans that are performing in accordance with or

better than our expectations as of the date of acquisition, as the fair values of these loans already reflect a credit

component. The allowance for loan and lease losses is increased through the provision for loan and lease losses

110