Capital One 2011 Annual Report Download - page 265

Download and view the complete annual report

Please find page 265 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298

|

|

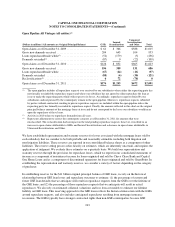

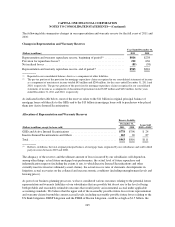

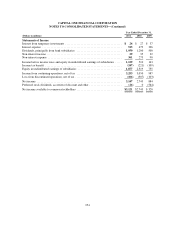

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

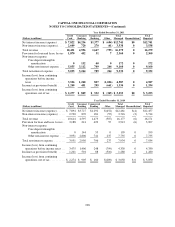

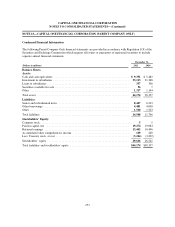

The following table summarizes changes in our representation and warranty reserve for the full years of 2011 and

2010:

Changes in Representation and Warranty Reserves

Year Ended December 31,

(Dollars in millions) 2011 2010

Representation and warranty repurchase reserve, beginning of period(1) .............. $816 $238

Provision for repurchase losses(2) ............................................ 212 636

Net realized losses ........................................................ (85) (58)

Representation and warranty repurchase reserve, end of period(1) ................... $943 $816

(1) Reported in our consolidated balance sheets as a component of other liabilities.

(2) The pre-tax portion of the provision for mortgage repurchase claims recognized in our consolidated statements of income

as a component of non-interest income totaled $43 million and $204 million, for the years ended December 31, 2011 and

2010, respectively. The pre-tax portion of the provision for mortgage repurchase claims recognized in our consolidated

statements of income as a component of discontinued operations totaled $169 million and $432 million, for the years

ended December 31, 2011 and 2010, respectively.

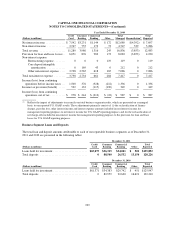

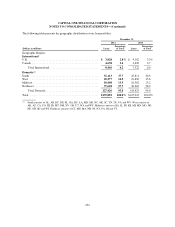

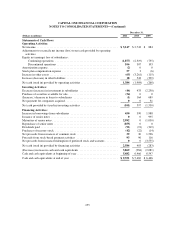

As indicated in the table below, most of the reserves relate to the $11 billion in original principal balance of

mortgage loans sold directly to the GSEs and to the $13 billion in mortgage loans sold to purchasers who placed

them into Active Insured Securitizations.

Allocation of Representation and Warranty Reserves

Reserve Liability

December 31, Loans Sold

2005 to 2008(1)

(Dollars in millions, except for loans sold) 2011 2010

GSEs and Active Insured Securitizations ................................ $778 $796 $ 24

Inactive Insured Securitizations and Others .............................. 165 20 87

Total ............................................................. $943 $816 $111

(1) Reflects, in billions, the total original principal balance of mortgage loans originated by our subsidiaries and sold to third

party investors between 2005 and 2008.

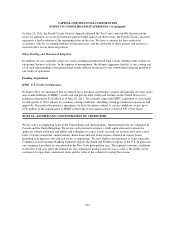

The adequacy of the reserves and the ultimate amount of losses incurred by our subsidiaries will depend on,

among other things, actual future mortgage loan performance, the actual level of future repurchase and

indemnification requests (including the extent, if any, to which Inactive Insured Securitizations and other

currently inactive investors ultimately assert claims), the actual success rates of claimants, developments in

litigation, actual recoveries on the collateral and macroeconomic conditions (including unemployment levels and

housing prices).

As part of our business planning processes, we have considered various outcomes relating to the potential future

representation and warranty liabilities of our subsidiaries that are possible but do not rise to the level of being

both probable and reasonably estimable outcomes that would justify an incremental accrual under applicable

accounting standards. We believe that the upper end of the reasonably possible future losses from representation

and warranty claims beyond the current accrual levels, including reasonably possible future losses relating to the

US Bank Litigation, DBSP Litigation and the FHLB of Boston Litigation, could be as high as $1.5 billion, the

245