Capital One 2011 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

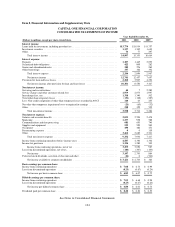

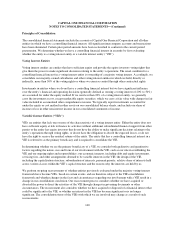

CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS

NOTE 1—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Company

Capital One Financial Corporation, which was established in 1995, is a diversified financial services holding

company headquartered in McLean, Virginia. Capital One Financial Corporation and its subsidiaries (the

“Company”) offer a broad array of financial products and services to consumers, small businesses and

commercial clients through branches, the internet and other distribution channels. Our principal subsidiaries

include Capital One Bank (USA), National Association (“COBNA”) and Capital One, National Association

(“CONA”). The Company and its subsidiaries are hereafter collectively referred to as “we”, “us” or “our.”

CONA and COBNA are hereafter collectively referred to as the “Banks.” As one of the top 10 largest banks in

the United States based on deposits, we serve banking customers through branch locations primarily in New

York, New Jersey, Texas, Louisiana, Maryland, Virginia and the District of Columbia. In addition to bank

lending and depository services, we offer credit and debit card products, mortgage banking and treasury

management services. We offer our products outside of the United States principally through operations in the

United Kingdom and Canada.

Our principal operations are currently organized into three primary business segments, which are defined based

on the products and services provided, or the type of customer served: Credit Card, Consumer Banking and

Commercial Banking.

•Credit Card: Consists of our domestic consumer and small business credit card lending, domestic small

business lending, national closed end installment lending and the international credit card lending businesses

in Canada and the United Kingdom.

•Consumer Banking: Consists of our branch-based lending and deposit gathering activities for consumer and

small businesses, national deposit gathering, national auto lending and consumer home loan lending and

servicing activities.

•Commercial Banking: Consists of our lending, deposit gathering and treasury management services to

commercial real estate and middle market customers. Our middle market customers typically include

commercial and industrial companies with annual revenues between $10 million and $1.0 billion.

Certain activities that are not part of a segment are included in the “Other” category. The results of our individual

businesses are prepared based on our internal management accounting system and reflect the manner in which

management measures and evaluates performance. The accounting policies with respect to activities specifically

attributable to each business segment are generally the same as those used in preparation of our consolidated

financial statements. However, the preparation of business line results requires management to allocate funding

costs and benefits, expenses and other financial elements to each line of business. For details of our business

segment accounting policies, allocation methodologies and business segment results, see “Note 20—Business

Segments.”

Basis of Presentation and Use of Estimates

The accompanying consolidated financial statements have been prepared in accordance with accounting

principles generally accepted in the United States (“U.S. GAAP”). Additionally, where applicable, the policies

conform to the accounting and reporting guidelines prescribed by bank regulatory authorities. The preparation of

financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions

that affect the amounts reported in the consolidated financial statements and related disclosures. These estimates

are based on information available as of the date of the consolidated financial statements. While management

makes its best judgment, actual amounts or results could differ from these estimates.

139