Capital One 2011 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

prepayment speeds and discount rates commensurate with the risks involved. We do not consolidate these trusts

because we do not have the right to receive benefits that could potentially be significant nor the obligation to

absorb losses that could potentially be significant to the trusts.

In connection with the securitization of certain option-ARM loans, a third party is obligated to advance a portion

of any “negative amortization” resulting from monthly payments that are less than the interest accrued for that

payment period. We have an agreement in place with the third party that mirrors this advance requirement. The

amount advanced is tracked through mortgage-backed securities retained as part of the securitization transaction.

As the borrowers make principal payments, these securities receive their net pro rata portion of those payments in

cash, and advances of negative amortization are refunded accordingly. As advances occur, we record an asset in

the form of negative amortization bonds, which are held at fair value in other assets. We have also entered into

certain derivative contracts related to the securitization activities. These are classified as free standing

derivatives, with fair value adjustments recorded in non-interest income. See “Note 11—Derivative Instruments

and Hedging Activities” for further details on these derivatives.

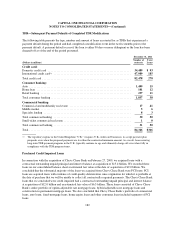

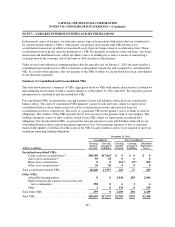

GreenPoint Mortgage HELOCs

Our discontinued wholesale mortgage banking unit, GreenPoint, previously sold home equity lines of credit in

whole loan sales and subsequently acquired a residual interest in certain trusts which securitized some of those

loans. As the residual interest holder, GreenPoint is required to fund advances on the home equity lines of credit

when certain performance triggers are met due to deterioration in asset performance. We had funded $28 million

in advances through December 31, 2011, all of which was expensed as funded. Our unfunded commitment

related to these residual interests was $10 million as of December 31, 2011. We have not consolidated these

trusts because the residual certificates did not provide the obligation to absorb losses or the right to receive

benefits that could potentially be significant to the trusts.

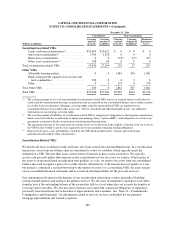

GreenPoint Mortgage Manufactured Housing

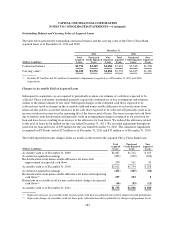

We retain the primary obligation for certain provisions of corporate guarantees, recourse sales and clean-up calls

related to the discontinued manufactured housing operations of GreenPoint Credit LLC (“GPC”) which was sold

to a third party in 2004. Although we are the primary obligor, recourse obligations related to former GPC whole

loan sales, commitments to exercise mandatory clean-up calls on certain GPC securitization transactions and

servicing were transferred to a third party in the sale transaction. We do not consolidate the trusts used for the

securitization of manufactured housing loans because we do not have the power to direct the activities that most

significantly impact the economic performance of the trusts since we no longer service the loans.

We were required to fund letters of credit in 2004 to cover losses, and are obligated to fund future amounts under

swap agreements for certain transactions. We have the right to receive any funds remaining in the letters of credit

after the securities are released. The amount available under the letters of credit was $172 million and $183

million at December 31, 2011 and 2010, respectively. The fair value of the expected residual balances on the

funded letters of credit was $51 million and $35 million at December 31, 2011 and 2010, respectively, and is

included in other assets on the consolidated balance sheet. Our maximum exposure under the swap agreements

was $23 million and $27 million at December 31, 2011 and 2010, respectively. The value of our obligations

under these swaps was $12 million and $18 million at December 31, 2011 and 2010, respectively and is recorded

in other liabilities on our consolidated balance sheet.

The unpaid principal balance of manufactured housing securitization transactions where we are the residual

interest holder was $1.3 billion and $1.4 billion at December 31, 2011 and 2010, respectively. In the event the

third party does not fulfill on its obligations to exercise the clean-up calls on certain transactions, the obligation

190