Capital One 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

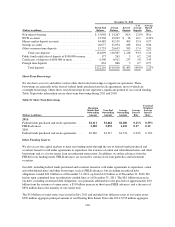

SEC rules, the shelf registration statement, which we filed in May 2009, expires three years after filing. As

previously discussed, during the third quarter of 2011, we issued four different series of our senior notes for total

proceeds of approximately $3.0 billion. The offering of senior notes included $250 million aggregate principal

amount of our Floating Rate Senior Notes due 2014, $750 million aggregate principal amount of our 2.125%

Senior Notes due 2014, $750 million aggregate principal amount of our 3.150% Senior Notes due 2016 and

$1.25 billion aggregate principal amount of our 4.750% Senior Notes due 2021.

In addition to issuance capacity under the shelf registration statement, we also have access to FHLB Advances

and Letters of Credit with a maximum borrowing capacity of $11.2 billion as of December 31, 2011. We had

$6.6 billion outstanding as of December 31, 2011, and $4.6 billion still available to us to borrow against under

this program. This funding source is non-revolving, and funding availability is subject to market conditions. The

ability to draw down funding is based on membership status, and the amount is dependent upon the Banks’

ability to post collateral.

Covenants

The terms of certain lease and credit facility agreements related to other borrowings and operating leases include

several financial covenants that require performance measures and equity ratios to be met. If these covenants are

not met, there may be an acceleration of the payment due dates noted in Table 38. As of December 31, 2011, we

were not in default of any such covenants.

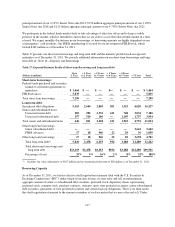

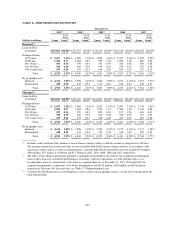

Contractual Obligations

In the normal course of business, we enter into various contractual obligations that may require future cash

payments that affect our short- and long-term liquidity and capital resource needs. Our primary future cash

outflows primarily relate to deposits, borrowings and operating leases. Table 38 summarizes, by remaining

contractual maturity, our significant contractual cash obligations based on the undiscounted future cash payments

as of December 31, 2011. The actual timing and amounts of future cash payments may differ from the amounts

presented below due to a number of factors, such as discretionary debt repurchases. Table 38 excludes certain

obligations where the obligation is short-term or subject to valuation based on market factors, such as trade

payables and trading liabilities. The table also excludes the representation and warranty reserve of $943 million

as of December 31, 2011 and obligations for pension and postretirement benefit plans, which are discussed in

more detail in “Note 17—Employee Benefit Plans.”

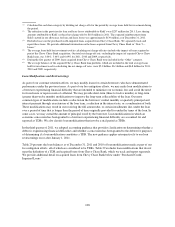

Table 38: Contractual Obligations

December 31, 2011

(Dollars in millions)

Up to 1

Year

> 1 Year

to 3 Years

> 3 Years

to 5 Years > 5 Years Total

Interest-bearing time deposits(1) ...................... $ 6,505 $ 7,008 $2,133 $ 411 $16,057

Senior and subordinated notes ....................... 640 3,249 2,354 4,791 11,034

Other borrowings(2) ............................... 12,480 6,481 1,869 7,697 28,527

Operating leases .................................. 172 330 282 806 1,590

Purchase obligations(3)(4) ............................ 323 121 86 37 567

Total obligations .................................. $20,120 $17,189 $6,724 $13,742 $57,775

(1) Includes only those interest bearing deposits which have a contractual maturity date.

(2) Other borrowings includes secured borrowings for our on-balance sheet auto loan securitizations, junior subordinated

capital securities and debentures, FHLB advances and other short-term borrowings.

(3) Represents agreements to purchase goods or services that are enforceable and legally binding and specify all significant

terms. The purchase obligations are included through the termination date of the agreements even if the contract is

renewable. These include capital expenditures, contractual commitments to purchase equipment and services, software

118