Capital One 2011 Annual Report Download - page 66

Download and view the complete annual report

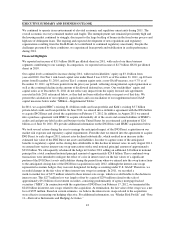

Please find page 66 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On February 16, 2012, we settled forward sale agreements that we entered into with certain counterparties acting

as forward purchasers in connection with a public offering of shares of our common stock on July 19, 2011.

Pursuant to the forward sale agreements, we issued 40 million shares of our common stock. After underwriter’s

discounts and commissions, the net proceeds to the company were at a forward sale price per share of $48.17 for

a total of approximately $1.9 billion.

We used the net proceeds of these offerings, along with cash sourced from current liquidity, to fund the $6.3

billion in cash consideration paid in connection with the ING Direct acquisition.

HSBC Acquisition—U.S. Credit Card Business

In August 2011, we entered into a purchase agreement to acquire substantially all of the assets and assume

liabilities of HSBC’s credit card and private-label credit card business in the United States for a premium

estimated at $2.6 billion as of June 30, 2011. We currently expect the HSBC acquisition to close in the second

quarter of 2012, subject to customary closing conditions, including certain governmental clearances and

approvals. Pursuant to the purchase agreement, we have the option, subject to certain conditions, to pay up to

$750 million of the consideration to HSBC in the form of our common stock (valued at $39.23 per share).

Business Outlook

We discuss below our current expectations regarding our total company performance and the performance of

each of our business segments over the near-term based on market conditions, the regulatory environment and

our business strategies as of the time we filed this Annual Report on Form 10-K. The statements contained in this

section are based on our current expectations regarding our outlook for our financial results and business

strategies. Our expectations take into account, and should be read in conjunction with, our expectations regarding

economic trends and analysis of our business as discussed in “Item 1. Business” and “MD&A” of this

report. Certain statements are forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Actual results could differ materially from those in our forward-looking

statements. Forward-looking statements do not reflect (i) any change in current dividend or repurchase strategies,

(ii) the effect of any acquisitions, divestitures or similar transactions, except for the forward-looking statements

specifically discussing the ING Direct acquisition or the pending acquisition of HSBC’s U.S. credit card

business, or (iii) any changes in laws, regulations or regulatory interpretations, in each case after the date as of

which such statements are made. See “Forward-Looking Statements” in “Item 1. Business” of this report for

factors that could materially influence our results.

Total Company Expectations

Our strategies and actions are designed to deliver profitable long-term growth through the acquisition and

retention of franchise-enhancing customer relationships across our businesses. We believe that franchise-

enhancing customer relationships produce strong long-term economics through low credit costs, low customer

attrition and a gradual build in loan balances and revenues over time. Examples of franchise-enhancing customer

relationships include rewards customers and new partnerships in our Credit Card business, long-term retail

deposit customers in our Consumer Banking business and primary banking relationships with commercial

customers in our Commercial Banking business. We intend to grow these customer relationships by continuing to

invest in our bank infrastructure to allow us to provide more convenient and flexible customer banking options,

including a broader range of fee-based and credit products and services, by leveraging our direct bank customer

franchise with national reach and by continued marketing investments to further strengthen our brand.

We believe our actions have created a well-positioned balance sheet and capital and liquidity levels which have

provided us with investment flexibility to take advantage of attractive opportunities and adjust, where we believe

appropriate, to changing market conditions. Our existing loan portfolio returned to growth in the second half of

2011, reflecting seasonal consumer spending trends and increasing balances in our private-label partnerships. We

expect loan balances to increase in 2012 with the addition of the ING Direct and HSBC loan portfolios. The

timing and pace of expected loan growth, excluding growth from acquired loans, will depend on broader

economic trends that impact overall consumer and commercial demand.

46