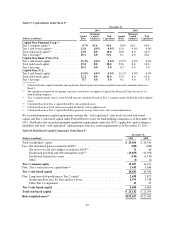

Capital One 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

$2.6 billion and $1.3 billion, respectively, as of December 31, 2011. Although funds are available for dividend

payments from the Banks, we would execute a dividend from the Banks in consultation with the OCC.

Applicable provisions that may be contained in our borrowing agreements or the borrowing agreements of our

subsidiaries may limit our subsidiaries’ ability to pay dividends to us or our ability to pay dividends to our

stockholders. There can be no assurance that we will declare and pay any dividends.

We submitted a Comprehensive Capital Analysis and Review (“CCAR 2012”) to the Federal Reserve on

January 9, 2012 along with eighteen other large U.S. banking organizations. We expect to incorporate any

feedback from our regulators in response to the CCAR 2012 submission in our ongoing capital management

planning.

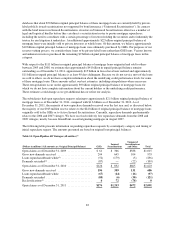

Settlement of Forward Sale Agreements

On February 16, 2012, we settled forward sale agreements that we entered into with certain counterparties acting

as forward purchasers in connection with a public offering of shares of our common stock on July 19, 2011.

Pursuant to the forward sale agreements, we issued 40 million shares of our common stock at settlement. After

underwriter’s discounts and commissions, the net proceeds to the company were at a forward sale price per share

of $48.17 for a total of approximately $1.9 billion.

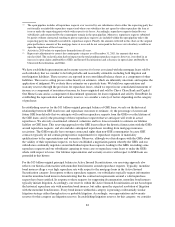

Pending HSBC U.S. Credit Card Business Acquisition

In August 2011, we announced that we entered into a purchase agreement with HSBC to acquire substantially all

of the assets and assume liabilities of HSBC’s credit card and private-label credit card business in the United

States. We currently expect the HSBC acquisition to close in the second quarter of 2012, subject to customary

closing conditions, including certain governmental clearances and approvals. We also announced that we expect

a planned capital raise of an estimated $1.25 billion in connection with the HSBC acquisition. We have the

option, subject to certain conditions, to issue $750 million of the $1.25 billion to HSBC in the form of our

common stock (valued at $39.23 per share). The decision to raise any capital and, if so, the amount of capital to

be raised will be dependent on a number of factors, including the timing of the closing of the pending HSBC

acquisition, changes in interest rates, regulatory expectations, our results of operations and financial condition

and our assessment of the appropriate level of regulatory capital to hold at that time.

RISK MANAGEMENT

Overview

Risk management is an important part of our business model, as all financial institutions are exposed to a variety

of business risks that can significantly affect their financial performance. Our business activities expose us to

eight major categories of risks: strategic risk, reputational risk, compliance risk, legal risk, liquidity risk, credit

risk, market risk and operational risk.

•Credit Risk: Credit risk is the risk of financial loss arising from a borrower’s or a counterparty’s inability to

meet its financial or contractual obligations.

•Liquidity Risk: Liquidity risk is the risk that we will not be able to meet our future financial obligations as

they come due or invest in future asset growth because of an inability to obtain funds at a reasonable price

within a reasonable time period.

•Market Risk: Market risk is the risk that our earnings and/or economic value of equity may be adversely

affected by changes in market conditions, including changes in interest rates and foreign currency exchange

rates, changes in credit spreads and price fluctuations and changes in value due to changes in market

perception or the actual credit quality of issuers.

•Compliance Risk: Compliance risk is the risk of financial loss due to regulatory fines or penalties, sanctions

restricting or suspending our business or costs of mandatory corrective action resulting from a failure to

89