Capital One 2011 Annual Report Download - page 161

Download and view the complete annual report

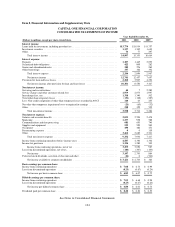

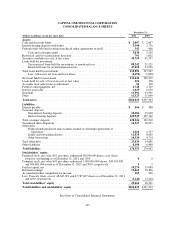

Please find page 161 of the 2011 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CAPITAL ONE FINANCIAL CORPORATION

NOTES TO CONSOLIDATED STATEMENTS—(Continued)

Cash and Cash Equivalents

Cash and cash equivalents include cash and due from banks, federal funds sold and resale agreements and

interest-bearing deposits at other banks, all of which, if applicable, have stated maturities of three months or less

when acquired. Cash payments for interest expense totaled $2.3 billion, $2.9 billion and $3.1 billion in 2011,

2010 and 2009, respectively. Cash payments for income taxes totaled $982 million, $350 million and $409

million in 2011, 2010 and 2009, respectively.

Resale and Repurchase Agreements

Securities purchased under agreements to resell and securities sold under agreements to repurchase, principally

U.S. government and agency obligations, are not accounted for as sales but as collateralized financing

transactions and recorded at the amounts at which the securities were acquired or sold, plus accrued interest. We

receive securities purchased under agreements to resell, make delivery of securities sold under agreements to

repurchase, continually monitor the market value of these securities and deliver or obtain additional collateral as

appropriate.

Investment Securities

Our investment securities consist primarily of fixed-income debt securities and equity securities. The accounting

and measurement framework for our investment securities differs depending on the security classification. We

classify securities as available for sale or held to maturity based on our investment strategy and management’s

assessment of our intent and ability to hold the securities until maturity. Securities that we intend to hold for an

indefinite period of time and may sell prior to maturity in response to changes in our investment strategy,

liquidity needs, interest rate risk profile or for other reasons are classified as available for sale. All of our

investment securities were classified as available for sale as of December 31, 2011 and 2010. Although we

currently do not have any securities classified as held-to-maturity, we may elect to do so in the future.

Available-for-sale securities are carried at fair value with unrealized net gains or losses, net of taxes, recorded in

accumulated other comprehensive income in stockholders’ equity. For most of our investment securities, interest

income is recognized using the effective interest method. Deferred items, including unamortized premiums,

discounts and other basis adjustments, are recognized in interest income over the contractual lives of the

securities using the effective interest method. We record purchases and sales of securities on a trade date basis.

Realized gains and losses from the sale of debt securities are computed using the specific identification method

and included in non-interest income in our consolidated statements of income.

We regularly evaluate our securities whose value has declined below amortized cost to assess whether the decline

in fair value is other-than-temporary. Amortized cost reflects historical cost adjusted for amortization of

premiums, accretion of discounts and other-than-temporary impairment writedowns. We discuss our assessment

of and accounting for other-than-temporary impairment in “Note 4—Investment Securities.” We discuss the

techniques we use in determining the fair value of our investment securities in “Note 19—Fair Value of Financial

Instruments.”

Loans

Our loan portfolio consists of credit card, other consumer and commercial loans. Other consumer loans consist of

auto, home, and retail banking loans. Commercial loans consist of commercial and multifamily real estate,

middle market, specialty lending and small-ticket commercial real estate loans. We historically have securitized

credit card loans, auto loans, home loans and installment loans through trusts we established to purchase the

141